US Cellular 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

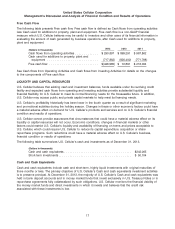

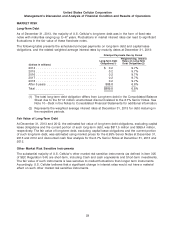

Apple iPhone Products Purchase Commitment

In March 2013, U.S. Cellular entered into an agreement with Apple to purchase certain minimum quantities of

iPhone products over a three-year period beginning in November 2013. The minimum quantity of iPhone

products to be purchased during the first contract year is fixed and is subject to adjustment for the second

and third contract years based on the percentage growth in smartphone sales in the United States for the

immediately preceding calendar year. Based on current forecasts, U.S. Cellular estimates that the remaining

contractual purchase commitment as of December 31, 2013 is approximately $950 million. At this time, U.S.

Cellular expects to meet its contractual commitment with Apple.

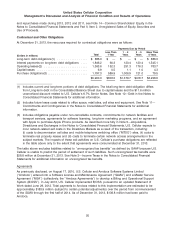

Off-Balance Sheet Arrangements

U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated entities

involving ‘‘off-balance sheet arrangements,’’ as defined by SEC rules, that had or are reasonably likely to

have a material current or future effect on its financial condition, changes in financial condition, revenues or

expenses, results of operations, liquidity, capital expenditures or capital resources.

Dividends

On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate amount of

$482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common Shares as of June 11,

2013.

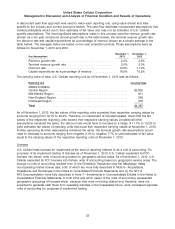

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

U.S. Cellular prepares its consolidated financial statements in accordance with GAAP. U.S. Cellular’s

significant accounting policies are discussed in detail in Note 1—Summary of Significant Accounting Policies

and Recent Accounting Pronouncements in the Notes to Consolidated Financial Statements.

Management believes the application of the following critical accounting policies and the estimates required

by such application reflect its most significant judgments and estimates used in the preparation of U.S.

Cellular’s consolidated financial statements. Management has discussed the development and selection of

each of the following accounting policies and related estimates and disclosures with the Audit Committee of

U.S. Cellular’s Board of Directors.

Goodwill and Licenses

See the Goodwill and Licenses Impairment Assessment section of Note 1—Summary of Significant

Accounting Policies and Recent Accounting Pronouncements in the Notes to Consolidated Financial

Statements for information on Goodwill and Licenses impairment testing policies and methods. U.S. Cellular

performs annual impairment testing of Goodwill and Licenses, as required by GAAP, in the fourth quarter of

its fiscal year, based on fair values and net carrying values determined as of November 1.

See Note 6—Intangible Assets in the Notes to Consolidated Financial Statements for additional information

related to Goodwill and Licenses activity in 2013 and 2012.

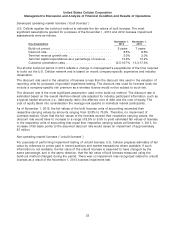

Goodwill

U.S. Cellular tests Goodwill for impairment at the level of reporting referred to as a reporting unit. For

purposes of impairment testing of Goodwill in 2013, U.S. Cellular identified four reporting units based on

geographic service areas. For purposes of the impairment testing of Goodwill in 2012, U.S. Cellular identified

five reporting units based on geographic service areas. The change in reporting units resulted from the

NY1 & NY2 Deconsolidation more fully described in Note 7—Investments in Unconsolidated Entities in the

Notes to Consolidated Financial Statements. There were no changes to U.S. Cellular’s overall Goodwill

impairment testing methodology between November 1, 2013 and November 1, 2012.

21