US Cellular 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

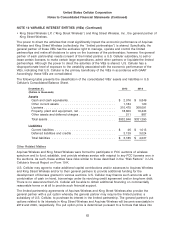

NOTE 12 VARIABLE INTEREST ENTITIES (VIEs) (Continued)

• King Street Wireless L.P. (‘‘King Street Wireless’’) and King Street Wireless, Inc., the general partner of

King Street Wireless.

The power to direct the activities that most significantly impact the economic performance of Aquinas

Wireless and King Street Wireless (collectively, the ‘‘limited partnerships’’) is shared. Specifically, the

general partner of these VIEs has the exclusive right to manage, operate and control the limited

partnerships and make all decisions to carry on the business of the partnerships; however, the general

partner of each partnership needs consent of the limited partner, a U.S. Cellular subsidiary, to sell or

lease certain licenses, to make certain large expenditures, admit other partners or liquidate the limited

partnerships. Although the power to direct the activities of the VIEs is shared, U.S. Cellular has a

disproportionate level of exposure to the variability associated with the economic performance of the

VIEs, indicating that U.S. Cellular is the primary beneficiary of the VIEs in accordance with GAAP.

Accordingly, these VIEs are consolidated.

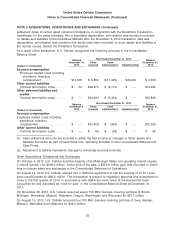

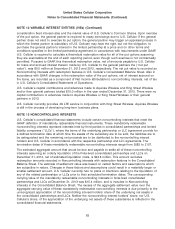

The following table presents the classification of the consolidated VIEs’ assets and liabilities in U.S.

Cellular’s Consolidated Balance Sheet.

December 31, 2013 2012

(Dollars in thousands)

Assets

Cash and cash equivalents .......................... $ 2,076 $ 5,849

Other current assets .............................. 1,184 120

Licenses ....................................... 310,475 308,091

Property, plant and equipment, net .................... 18,600 16,443

Other assets and deferred charges .................... 511 887

Total assets ..................................... $332,846 $331,390

Liabilities

Current liabilities ................................. $ 46 $ 1,013

Deferred liabilities and credits ........................ 3,139 3,024

Total liabilities ................................... $ 3,185 $ 4,037

Other Related Matters

Aquinas Wireless and King Street Wireless were formed to participate in FCC auctions of wireless

spectrum and to fund, establish, and provide wireless service with respect to any FCC licenses won in

the auctions. As such, these entities have risks similar to those described in the ‘‘Risk Factors’’ in U.S.

Cellular’s Annual Report on Form 10-K.

U.S. Cellular may agree to make additional capital contributions and/or advances to Aquinas Wireless

and King Street Wireless and/or to their general partners to provide additional funding for the

development of licenses granted in various auctions. U.S. Cellular may finance such amounts with a

combination of cash on hand, borrowings under its revolving credit agreement and/or long-term debt.

There is no assurance that U.S. Cellular will be able to obtain additional financing on commercially

reasonable terms or at all to provide such financial support.

The limited partnership agreements of Aquinas Wireless and King Street Wireless also provide the

general partner with a put option whereby the general partner may require the limited partner, a

subsidiary of U.S. Cellular, to purchase its interest in the limited partnership. The general partner’s put

options related to its interests in King Street Wireless and Aquinas Wireless will become exercisable in

2019 and 2020, respectively. The put option price is determined pursuant to a formula that takes into

62