US Cellular 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

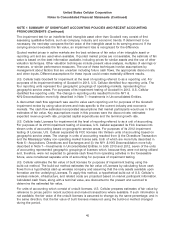

Notes to Consolidated Financial Statements (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

is a two-step process. The first step compares the carrying value of the asset (or asset group) with the

estimated undiscounted cash flows over the remaining asset (or asset group) life. If the carrying value of

the asset (or asset group) is greater than the undiscounted cash flows, the second step of the test is

performed to measure the amount of impairment loss. The second step compares the carrying value of

the asset to its estimated fair value. If the carrying value exceeds the estimated fair value (less cost to

sell), an impairment loss is recognized for the difference.

U.S. Cellular has one asset group for purposes of assessing property, plant and equipment for

impairment based on the fact that the individual operating markets are reliant on centrally operated data

centers, mobile telephone switching offices, network operations center and wide-area network. As a

result, U.S. Cellular operates a single integrated national wireless network, and the lowest level for which

identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities

represent cash flows generated by this single interdependent network.

Quoted market prices in active markets are the best evidence of fair value of a tangible long-lived asset

and are used when available. If quoted market prices are not available, the estimate of fair value is

based on the best information available, including prices for similar assets and the use of other valuation

techniques. A present value analysis of cash flow scenarios is often the best available valuation

technique. The use of this technique involves assumptions by management about factors that are

uncertain including future cash flows, the appropriate discount rate and other inputs. Different

assumptions for these inputs could create materially different results.

Agent Liabilities

U.S. Cellular has relationships with agents, which are independent businesses that obtain customers for

U.S. Cellular. At December 31, 2013 and 2012, U.S. Cellular had accrued $121.3 million and

$88.2 million, respectively, for amounts due to agents. This amount is included in Other current liabilities

in the Consolidated Balance Sheet.

Other Assets and Deferred Charges

Other assets and deferred charges include underwriters’ and legal fees and other charges related to

issuing U.S. Cellular’s various borrowing instruments and other long-term agreements, and are amortized

over the respective term of each instrument. The amounts for deferred charges included in the

Consolidated Balance Sheet at December 31, 2013 and 2012, are shown net of accumulated

amortization of $26.0 million and $12.7 million, respectively.

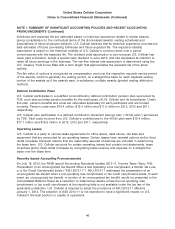

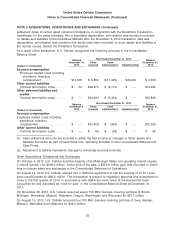

Asset Retirement Obligations

U.S. Cellular operates cell sites, retail stores and office spaces in its operating markets. A majority of

these sites, stores and office spaces are leased. Most of these leases contain terms which require or

may require U.S. Cellular to return the leased property to its original condition at the lease expiration

date.

U.S. Cellular accounts for asset retirement obligations by recording the fair value of a liability for legal

obligations associated with an asset retirement in the period in which the obligations are incurred. At the

time the liability is incurred, U.S. Cellular records a liability equal to the net present value of the

estimated cost of the asset retirement obligation and increases the carrying amount of the related

long-lived asset by an equal amount. The liability is accreted to its present value over a period ending

with the estimated settlement date of the respective asset retirement obligation. The carrying amount of

the long-lived asset is depreciated over the useful life of the asset. Upon settlement of the obligation, any

42