US Cellular 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

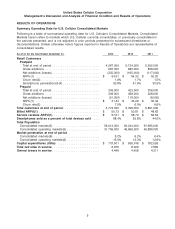

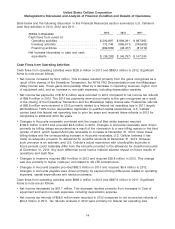

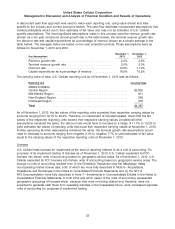

table below and the following discussion in this Financial Resources section summarize U.S. Cellular’s

cash flow activities in 2013, 2012 and 2011.

2013 2012 2011

(Dollars in thousands)

Cash flows from (used in)

Operating activities ..................... $290,897 $ 899,291 $ 987,862

Investing activities ...................... 172,749 (896,611) (759,603)

Financing activities ..................... (499,939) (48,477) (81,019)

Net increase (decrease) in cash and cash

equivalents ........................... $ (36,293) $ (45,797) $ 147,240

Cash Flows from Operating Activities

Cash flows from operating activities were $290.9 million in 2013 and $899.3 million in 2012. Significant

items to note are as follows:

• Net income increased by $3.4 million. This increase resulted primarily from the gains recognized as a

result of the closing of the Divestiture Transaction, the NY1& NY2 Deconsolidation and the Mississippi

Valley license sale. These gains were partially offset by a decrease in Operating revenues, higher cost

of equipment sold, and an increase in non-cash expenses, including depreciation expense.

• Net income tax payments of $157.8 million were recorded in 2013 compared to net income tax refunds

of $58.6 million in 2012. The 2013 tax payments were due primarily to the gain recognized as a result

of the closing of the Divestiture Transaction and the Mississippi Valley license sale. Federal tax refunds

of $66.8 million were received in 2012 primarily related to a federal net operating loss in 2011 largely

attributable to 100% bonus depreciation applicable to qualified capital expenditures. U.S. Cellular

carried back this federal net operating loss to prior tax years and received these refunds in 2012 for

carrybacks to 2009 and 2010 tax years.

• Changes in Accounts receivable combined with the impact of Bad debts expense required

$192.9 million in 2013 and provided $2.6 million in 2012. Changes in Accounts receivable were driven

primarily by billing delays encountered as a result of the conversion to a new billing system in the third

quarter of 2013, which caused Accounts receivable to increase at December 31, 2013. Given these

billing delays and the corresponding increase in Accounts receivable, U.S. Cellular believes it has

made an adequate provision for allowance for doubtful accounts at December 31, 2013. However,

such provision is an estimate, and U.S. Cellular’s actual experience with uncollectible accounts in

future periods could materially differ from the amounts provided in the allowance for doubtful accounts

at December 31, 2013. Any such difference could have a material adverse impact on future results of

operations and cash flow.

• Changes in Inventory required $82.4 million in 2013 and required $28.8 million in 2012. This change

was due primarily to higher costs per unit related to 4G LTE smartphones.

• Changes in Accounts payable provided $85.3 million in 2013 and required $6.4 million in 2012.

Changes in Accounts payable were driven primarily by payment timing differences related to operating

expenses, capital expenditures and device purchases.

Cash flows from operating activities were $899.3 million in 2012 and $987.9 million in 2011. Significant

items to note are as follows:

• Net income decreased by $57.7 million. This decrease resulted primarily from increases in Cost of

equipment sold and non-cash expenses, including depreciation expense.

• Net income tax refunds of $58.6 million were recorded in 2012 compared to net income tax refunds of

$54.4 million in 2011. Tax refunds received in 2012 were primarily for federal net operating loss

14