US Cellular 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 5 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

Divestiture Transaction

On November 6, 2012, U.S. Cellular entered into a Purchase and Sale Agreement with subsidiaries of

Sprint Corp., fka Sprint Nextel Corporation (‘‘Sprint’’). Pursuant to the Purchase and Sale Agreement, on

May 16, 2013, U.S. Cellular transferred customers and certain PCS license spectrum to Sprint in U.S.

Cellular’s Chicago, central Illinois, St. Louis and certain Indiana/Michigan/Ohio markets (‘‘Divestiture

Markets’’) in consideration for $480 million in cash. The Purchase and Sale Agreement also

contemplated certain other agreements, together with the Purchase and Sale Agreement collectively

referred to as the ‘‘Divestiture Transaction.’’

U.S. Cellular retained other assets and liabilities related to the Divestiture Markets, including network

assets, retail stores and related equipment, and other buildings and facilities. The transaction did not

affect spectrum licenses held by U.S. Cellular or variable interest entities (‘‘VIEs’’) that were not used in

the operations of the Divestiture Markets. Pursuant to the Purchase and Sale Agreement, U.S. Cellular

and Sprint also entered into certain other agreements, including customer and network transition

services agreements, which require U.S. Cellular to provide customer, billing and network services to

Sprint for a period of up to 24 months after the May 16, 2013 closing date. Sprint will reimburse U.S.

Cellular for providing such services at an amount equal to U.S. Cellular’s estimated costs, including

applicable overhead allocations. In addition, these agreements require Sprint to reimburse U.S. Cellular

up to $200 million (the ‘‘Sprint Cost Reimbursement’’) for certain network decommissioning costs,

network site lease rent and termination costs, network access termination costs, and employee

termination benefits for specified engineering employees. It is estimated that up to $175 million of the

Sprint Cost Reimbursement will be recorded in (Gain) loss on sale of business and other exit costs, net

and up to $25 million of the Sprint Cost Reimbursement will be recorded in System operations in the

Consolidated Statement of Operations. For the year ended December 31, 2013, $10.6 million of the

Sprint Cost Reimbursement had been received and recorded in Cash received from divestitures in the

Consolidated Statement of Cash Flows.

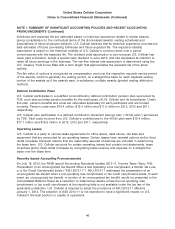

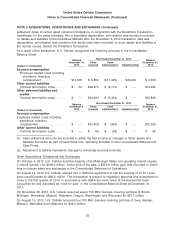

Financial impacts of the Divestiture Transaction are classified in the Consolidated Statement of

Operations within Operating income. The table below describes the amounts U.S. Cellular has

recognized and expects to recognize in the Consolidated Statement of Operations between the date the

Purchase and Sale Agreement was signed and the end of the transition services period.

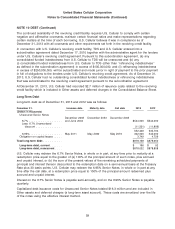

Actual

Actual Amount

Actual Amount Recognized

Cumulative Amount Recognized Three Months

Amount Recognized Three Months and Year

Expected Recognized as Year Ended Ended Ended

Period of of December 31, December 31, December 31, December 31,

Recognition Projected Range 2013 2013 2013 2012

(Dollars in thousands)

(Gain) loss on sale of business and other exit costs, net

Proceeds from Sprint

Purchase price ..................... 2013 $(480,000) $(480,000) $(480,000) $(480,000) $ — $ —

Sprint Cost Reimbursement ............... 2013-2014 (120,000) (175,000) (47,641) (47,641) (43,420) —

Net assets transferred ................... 2013 213,593 213,593 213,593 213,593 — —

Non-cash charges for the write-off and write-down of

property under construction and related assets .... 2012-2014 10,000 14,000 10,675 3 (51) 10,672

Employee related costs including severance, retention

and outplacement .................... 2012-2014 12,000 18,000 14,262 1,653 (809) 12,609

Contract termination costs ................ 2012-2014 110,000 160,000 59,584 59,525 40,744 59

Transaction costs ..................... 2012-2014 5,000 6,000 5,565 4,428 347 1,137

Total (Gain) loss on sale of business and other exit

costs, net ....................... $(249,407) $(243,407) $(223,962) $(248,439) $ (3,189) $24,477

Depreciation, amortization and accretion expense

Incremental depreciation, amortization and accretion, net

of salvage values .................... 2012-2014 200,000 225,000 198,571 178,513 44,513 20,058

(Increase) decrease in Operating income ........ $(49,407) $ (18,407) $ (25,391) $ (69,926) $ 41,324 $44,535

Incremental depreciation, amortization and accretion, net of salvage values represents anticipated

amounts to be recorded in the specified time periods as a result of a change in estimate for the

remaining useful life and salvage value of certain assets and a change in estimate which accelerated the

51