US Cellular 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

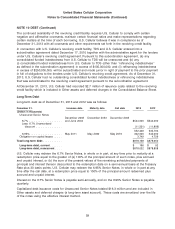

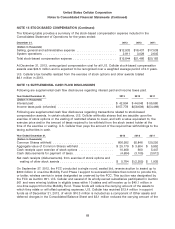

NOTE 16 SUPPLEMENTAL CASH FLOW DISCLOSURES (Continued)

assets to which they relate, which are included in Property, plant and equipment in the Consolidated

Balance Sheet.

On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate

amount of $482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common Shares

as of June 11, 2013.

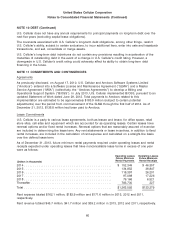

NOTE 17 RELATED PARTIES

U.S. Cellular is billed for all services it receives from TDS, pursuant to the terms of various agreements

between it and TDS. These billings are included in U.S. Cellular’s Selling, general and administrative

expenses. Some of these agreements were established at a time prior to U.S. Cellular’s initial public

offering when TDS owned more than 90% of U.S. Cellular’s outstanding capital stock and may not reflect

terms that would be obtainable from an unrelated third party through arms-length negotiations. Billings

from TDS to U.S. Cellular are based on expenses specifically identified to U.S. Cellular and on

allocations of common expenses. Such allocations are based on the relationship of U.S. Cellular’s

assets, employees, investment in property, plant and equipment and expenses relative to all subsidiaries

in the TDS consolidated group. Management believes the method TDS uses to allocate common

expenses is reasonable and that all expenses and costs applicable to U.S. Cellular are reflected in its

financial statements. Billings to U.S. Cellular from TDS totaled $99.2 million, $104.3 million and

$104.1 million in 2013, 2012 and 2011, respectively.

The Audit committee of the Board of Directors of U.S. Cellular is responsible for the review and

evaluation of all related party transactions as such term is defined by the rules of the New York Stock

Exchange (‘‘NYSE’’).

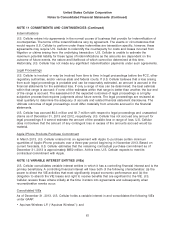

NOTE 18 CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following persons are partners of Sidley Austin LLP, the principal law firm of U.S. Cellular and its

subsidiaries: Walter C.D. Carlson, a director of U.S. Cellular, a director and non-executive Chairman of

the Board of Directors of TDS and a trustee and beneficiary of a voting trust that controls TDS; William S.

DeCarlo, the General Counsel of TDS and an Assistant Secretary of TDS and certain subsidiaries of TDS;

and Stephen P. Fitzell, the General Counsel of U.S. Cellular and TDS Telecommunications Corporation

and an Assistant Secretary of U.S. Cellular and certain other subsidiaries of TDS. Walter C.D. Carlson

does not provide legal services to TDS, U.S. Cellular or their subsidiaries. U.S. Cellular and its

subsidiaries incurred legal costs from Sidley Austin LLP of $13.2 million in 2013, $10.7 million in 2012

and $9.2 million in 2011.

The Audit Committee of the Board of Directors is responsible for the review and evaluation of all related-

party transactions as such term is defined by the rules of the New York Stock Exchange.

69