US Cellular 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

NOTE 3 INCOME TAXES (Continued)

At December 31, 2013, U.S. Cellular and certain subsidiaries had $1,149.4 million of state NOL

carryforwards (generating a $51.1 million deferred tax asset) available to offset future taxable income.

The state NOL carryforwards expire between 2014 and 2033. Certain subsidiaries had federal NOL

carryforwards (generating a $10.2 million deferred tax asset) available to offset their future taxable

income. The federal NOL carryforwards expire between 2018 and 2033. A valuation allowance was

established for certain state NOL carryforwards and federal NOL carryforwards since it is more likely than

not that a portion of such carryforwards will expire before they can be used.

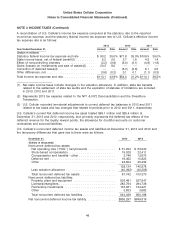

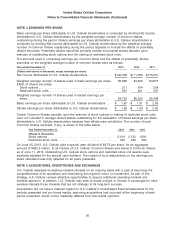

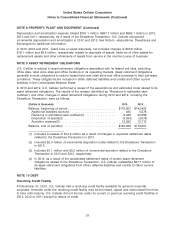

A summary of U.S. Cellular’s deferred tax asset valuation allowance is as follows:

2013 2012 2011

(Dollars in thousands)

Balance at January 1, ...................................... $41,295 $30,261 $29,891

Charged to income tax expense ............................. (1,527) 3,033 (1,450)

Charged to other accounts ................................. 3,607 8,001 1,820

Balance at December 31, ................................... $43,375 $41,295 $30,261

As of December 31, 2013, the valuation allowance reduced current deferred tax assets by $3.0 million

and noncurrent deferred tax assets by $40.4 million.

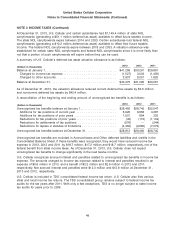

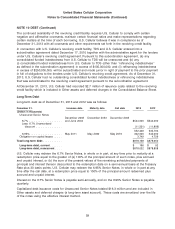

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

2013 2012 2011

(Dollars in thousands)

Unrecognized tax benefits balance at January 1, ................... $26,460 $28,745 $32,547

Additions for tax positions of current year ...................... 5,925 6,656 4,487

Additions for tax positions of prior years ....................... 1,501 854 332

Reductions for tax positions of prior years ...................... (45) (115) (1,104)

Reductions for settlements of tax positions ..................... (576) — (244)

Reductions for lapses in statutes of limitations ................... (4,452) (9,680) (7,273)

Unrecognized tax benefits balance at December 31, ................ $28,813 $26,460 $28,745

Unrecognized tax benefits are included in Accrued taxes and Other deferred liabilities and credits in the

Consolidated Balance Sheet. If these benefits were recognized, they would have reduced income tax

expense in 2013, 2012 and 2011 by $18.7 million, $17.2 million and $18.7 million, respectively, net of the

federal benefit from state income taxes. As of December 31, 2013, U.S. Cellular does not expect

unrecognized tax benefits to change significantly in the next twelve months.

U.S. Cellular recognizes accrued interest and penalties related to unrecognized tax benefits in Income tax

expense. The amounts charged to Income tax expense related to interest and penalties resulted in an

expense of $0.6 million in 2013, and a benefit of $2.2 million and $2.6 million in 2012 and 2011,

respectively. Net accrued interest and penalties were $12.3 million and $12.8 million at December 31,

2013 and 2012, respectively.

U.S. Cellular is included in TDS’ consolidated federal income tax return. U.S. Cellular also files various

state and local income tax returns. The TDS consolidated group remains subject to federal income tax

audits for the tax years after 2011. With only a few exceptions, TDS is no longer subject to state income

tax audits for years prior to 2009.

49