US Cellular 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

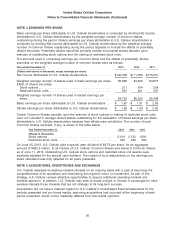

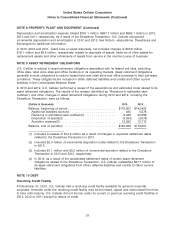

NOTE 3 INCOME TAXES (Continued)

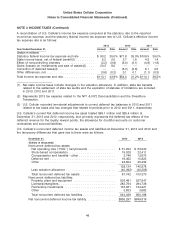

A reconciliation of U.S. Cellular’s income tax expense computed at the statutory rate to the reported

income tax expense, and the statutory federal income tax expense rate to U.S. Cellular’s effective income

tax expense rate is as follows:

2013 2012 2011

Year Ended December 31, Amount Rate Amount Rate Amount Rate

(Dollars in millions)

Statutory federal income tax expense and rate ........ $ 90.2 35.0% $71.8 35.0% $109.5 35.0%

State income taxes, net of federal benefit(1) .......... 5.2 2.0 3.7 1.8 4.5 1.4

Effect of noncontrolling interests .................. (2.2) (0.9) (6.3) (3.1) (4.9) (1.6)

Gains (losses) on investments and sale of assets(2) .... 20.5 8.0 — — — —

Correction of deferred taxes(3) ................... — — (5.3) (2.6) 6.1 2.0

Other differences, net .......................... (0.6) (0.2) 0.1 0.1 (1.1) (0.3)

Total income tax expense and rate ................. $113.1 43.9% $64.0 31.2% $114.1 36.5%

(1) Net state income taxes include changes in the valuation allowance. In addition, state tax benefits

related to the settlement of state tax audits and the expiration of statutes of limitations are included

in 2013, 2012 and 2011.

(2) Represents 2013 tax expense related to the NY1 & NY2 Deconsolidation and the Divestiture

Transaction.

(3) U.S. Cellular recorded immaterial adjustments to correct deferred tax balances in 2012 and 2011

related to tax basis and law changes that related to periods prior to 2012 and 2011, respectively.

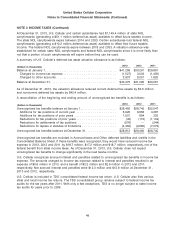

U.S. Cellular’s current Net deferred income tax asset totaled $99.1 million and $35.4 million at

December 31, 2013 and 2012, respectively, and primarily represents the deferred tax effects of the

deferred revenue for the loyalty reward points, the allowance for doubtful accounts on customer

receivables and accrued liabilities.

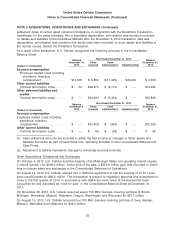

U.S. Cellular’s noncurrent deferred income tax assets and liabilities at December 31, 2013 and 2012 and

the temporary differences that gave rise to them were as follows:

December 31, 2013 2012

(Dollars in thousands)

Noncurrent deferred tax assets

Net operating loss (‘‘NOL’’) carryforwards ............... $ 61,294 $ 63,240

Stock-based compensation .......................... 19,028 22,411

Compensation and benefits—other .................... 3,746 13,673

Deferred rent .................................... 19,462 15,822

Other ......................................... 24,604 25,432

128,134 140,578

Less valuation allowance ........................... (40,392) (40,208)

Total noncurrent deferred tax assets ................... 87,742 100,370

Noncurrent deferred tax liabilities

Property, plant and equipment ....................... 503,491 527,547

Licenses/intangibles ............................... 282,764 294,738

Partnership investments ............................ 133,931 124,221

Other ......................................... 3,853 3,682

Total noncurrent deferred tax liabilities .................. 924,039 950,188

Net noncurrent deferred income tax liability ............... $836,297 $849,818

48