US Cellular 2013 Annual Report Download - page 33

Download and view the complete annual report

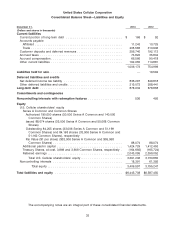

Please find page 33 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

in determining the provision for income taxes, deferred income tax assets and liabilities and any

valuation allowance that is established for deferred income tax assets.

U.S. Cellular recognizes the tax benefit from an uncertain tax position only if it is more likely than not that

the tax position will be sustained on examination by the taxing authorities, based on the technical merits

of the position. The tax benefits recognized in the financial statements from such a position are

measured based on the largest benefit that has a greater than 50% likelihood of being realized upon

ultimate resolution.

See Note 3—Income Taxes in the Notes to Consolidated Financial Statements for details regarding U.S.

Cellular’s income tax provision, deferred income taxes and liabilities, valuation allowances and

unrecognized tax benefits, including information regarding estimates that impact income taxes.

Loyalty Reward Program

See the Revenue Recognition section of Note 1—Summary of Significant Accounting Policies and Recent

Accounting Pronouncements in the Notes to Consolidated Financial Statements for a description of this

program and the related accounting.

U.S. Cellular follows the deferred revenue method of accounting for its loyalty reward program. Under

this method, revenue allocated to loyalty reward points is deferred. Revenue is recognized at the time of

customer redemption or when such points have been depleted via an account maintenance charge. U.S.

Cellular periodically reviews and revises the redemption and depletion rates as appropriate based on

history and related future expectations. As of December 31, 2013, U.S. Cellular estimated loyalty reward

points breakage based on actuarial estimates and recorded a $7.4 million change in estimate, which

reduced Customer deposits and deferred revenues in the Consolidated Balance Sheet and increased

Total operating revenues in the Consolidated Statement of Operations.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

See Note 17—Related Parties and Note 18—Certain Relationships and Related Transactions in the Notes

to Consolidated Financial Statements.

Possible related party transaction

U.S. Cellular is currently considering a possible purchase of FCC spectrum licenses from TDS. U.S.

Cellular’s spectrum requirements and the relative value of the FCC licenses are being reviewed. U.S.

Cellular formed a special committee comprised entirely of independent and disinterested directors with

the exclusive power to consider, negotiate and, if appropriate, approve a transaction with TDS. The U.S.

Cellular special committee has engaged independent financial advisors and legal counsel. There is no

assurance as to whether a transaction will be consummated.

25