US Cellular 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

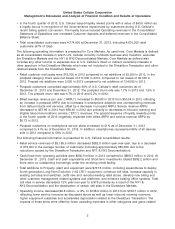

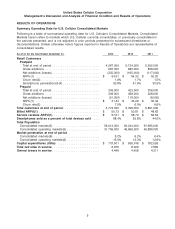

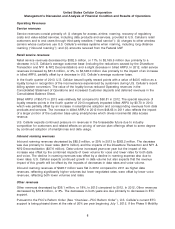

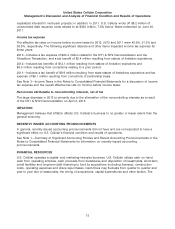

Summary Operating Data for U.S. Cellular Core Markets

Following is a table of summarized operating data for U.S. Cellular’s Core Markets (which excludes the

Divestiture Markets and NY1 and NY2 markets) as of or for the year ended December 31, 2013 or 2012.

As of or for the Year Ended December 31, 2013 2012

Retail Customers

Postpaid

Total at end of period ........................ 4,267,000 4,496,000

Gross additions ............................ 682,000 746,000

Net additions (losses) ....................... (217,000) (92,000)

ARPU(1) ................................. $ 54.23 $ 53.65

Churn rate(2) .............................. 1.7% 1.5%

Smartphone penetration(3)(4) .................. 50.8% 41.1%

Prepaid

Total at end of period ........................ 343,000 342,000

Gross additions ............................ 295,000 288,000

Net additions (losses) ....................... 2,000 124,000

ARPU(1) ................................. $ 31.45 $ 32.98

Churn rate(2) .............................. 6.7% 5.2%

Total customers at end of period ................. 4,774,000 5,022,000

Billed ARPU(1) ............................... $ 50.82 $ 50.54

Service revenue ARPU(1) ....................... $ 57.66 $ 58.49

Smartphones sold as a percent of total devices sold . . 68.6% 56.1%

Total Population

Consolidated markets(5) ....................... 58,013,000 83,384,000

Consolidated operating markets(5) ................ 31,759,000 31,445,000

Market penetration at end of period

Consolidated markets(6) ....................... 8.2% 6.0%

Consolidated operating markets(6) ................ 15.0% 16.0%

Capital expenditures (000s) ..................... $ 735,082 $ 768,884

Total cell sites in service ....................... 6,161 6,130

Owned towers in service ....................... 3,913 3,847

(1) ARPU metrics are calculated by dividing a revenue base by an average number of

customers by the number of months in the period. These revenue bases and customer

populations are shown below:

a. Postpaid ARPU consists of total postpaid service revenues and postpaid customers.

b. Prepaid ARPU consists of total prepaid service revenues and prepaid customers.

c. Billed ARPU consists of total postpaid, prepaid and reseller service revenues and

postpaid, prepaid and reseller customers.

d. Service revenue ARPU consists of total retail service revenues, inbound roaming and

other service revenues and postpaid, prepaid and reseller customers.

(2) Churn metrics represent the percentage of the postpaid or prepaid customers that

disconnects service each month. These metrics represent the average monthly postpaid or

prepaid churn rate for each respective period.

(3) Smartphones represent wireless devices which run on an Android, Apple, BlackBerry or

Windows Mobile operating system, excluding tablets.

6