US Cellular 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

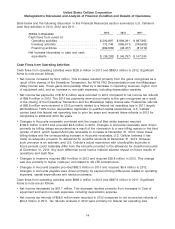

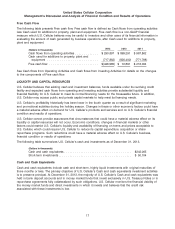

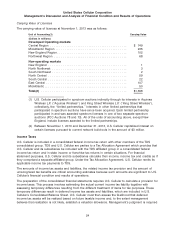

Cash received from divestitures in 2013, 2012 and 2011 were as follows:

Cash Received from Divestitures 2013 2012 2011

(Dollars in thousands)

Licenses ..................................... $311,989 $ — $—

Businesses ................................... 499,131 49,932 —

Total ........................................ $811,120 $49,932 $—

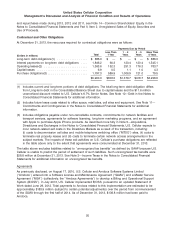

U.S. Cellular received $480.0 million in cash at the close of the Divestiture Transaction in May 2013. In

addition, U.S. Cellular received $10.6 million in reimbursements for certain network decommissioning

costs, network site lease rent and termination costs, network access termination costs, and employee

termination benefits for specified engineering employees (the ‘‘Sprint Cost Reimbursement’’) in 2013.

On October 4, 2013, U.S. Cellular sold the majority of its Mississippi Valley unbuilt license for

$308.0 million. This sale resulted in a $250.6 million gain which was recorded in the fourth quarter of

2013.

On August 14, 2013 U.S. Cellular entered into a definitive agreement to sell the majority of its St. Louis

area unbuilt license for $92.3 million. The sale will result in an estimated pre-tax gain of $76.2 million.

This transaction is subject to regulatory approval and is expected to close in the first quarter of 2014.

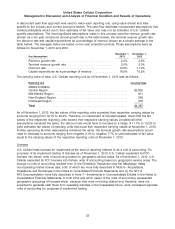

U.S. Cellular invested $120.0 million and $110.0 million in 2012 and 2011, respectively, in U.S. Treasury

Notes and corporate notes with maturities greater than three months from the acquisition date. U.S.

Cellular realized cash proceeds of $100.0 million, $125.0 million, and $145.3 million in 2013, 2012, and

2011, respectively, related to the maturities of its investments in U.S. Treasury Notes and corporate notes.

Cash Flows from Financing Activities

Cash flows from financing activities include repayments of and proceeds from short-term and long-term

debt, dividends to shareholders, distributions to noncontrolling interests, cash used to repurchase

Common Shares and cash proceeds from reissuance of Common Shares pursuant to stock-based

compensation plans.

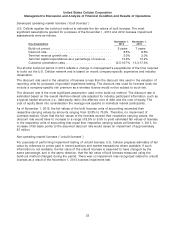

In May 2011, U.S. Cellular issued $342.0 million of 6.95% Senior Notes due 2060, and paid related debt

issuance costs of $11.0 million. The net proceeds from the 6.95% Senior Notes were used primarily to

redeem $330.0 million of U.S. Cellular’s 7.5% Senior Notes in June 2011. The redemption price of the

7.5% Senior Notes was equal to 100% of the principal amount plus accrued and unpaid interest thereon

to the redemption date.

On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate

amount of $482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common Shares

as of June 11, 2013.

U.S. Cellular repurchased Common Shares for $18.5 million, $20.0 million and $62.3 million in 2013,

2012 and 2011, respectively. See Note 14—Common Shareholders’ Equity in the Notes to Consolidated

Financial Statements for additional information related to these transactions.

16