US Cellular 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

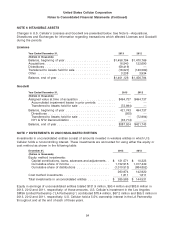

Notes to Consolidated Financial Statements (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

• Loyalty reward points—By estimating the retail price of the products and services for which points may

be redeemed and dividing such amount by the number of loyalty points required to receive such

products and services. This is calculated on a weighted average basis and requires U.S. Cellular to

estimate the percentage of loyalty points that will be redeemed for each product or service.

U.S. Cellular follows the deferred revenue method of accounting for its loyalty reward program. Under

this method, revenue allocated to loyalty reward points is deferred. Revenue is recognized at the time of

customer redemption or when such points have been depleted via an account maintenance charge. U.S.

Cellular periodically reviews and revises the redemption and depletion rates as appropriate based on

history and related future expectations. As of December 31, 2013, U.S. Cellular estimated loyalty reward

points breakage based on actuarial estimates and recorded a $7.4 million change in estimate, which

reduced Customer deposits and deferred revenues in the Consolidated Balance Sheet and increased

Service revenues in the Consolidated Statement of Operations.

In the fourth quarter of 2013, U.S. Cellular issued loyalty reward points with a value of $43.5 million as a

loyalty bonus in recognition of the inconvenience experienced by customers during U.S. Cellular’s recent

billing system conversion. The value of the loyalty bonus reduced Service revenues in the Consolidated

Statement of Operations and increased Customer deposits and deferred revenues in the Consolidated

Balance Sheet.

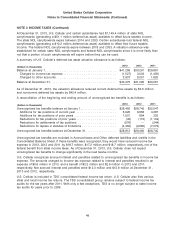

As of December 31, 2013 and 2012, U.S. Cellular had deferred revenue related to loyalty reward points

outstanding of $116.2 million and $56.6 million, respectively. These amounts are recorded in Customer

deposits and deferred revenues (a current liability account) in the Consolidated Balance Sheet, as

customers may redeem their reward points within the current period.

Cash-based discounts and incentives, including discounts to customers who pay their bills through the

use of on-line bill payment methods, are recognized as a reduction of Operating revenues concurrently

with the associated revenue, and are allocated to the various products and services in the bundled

offering based on their respective relative selling price.

In order to provide better control over wireless device quality, U.S. Cellular sells wireless devices to

agents. U.S. Cellular pays rebates to agents at the time an agent activates a new customer or retains an

existing customer in a transaction involving a wireless device. U.S. Cellular accounts for these rebates by

reducing revenues at the time of the wireless device sale to the agent rather than at the time the agent

activates a new customer or retains a current customer. Similarly, U.S. Cellular offers certain wireless

device sales rebates and incentives to its retail customers and records the revenue net of the

corresponding rebate or incentive. The total potential rebates and incentives are reduced by U.S.

Cellular’s estimate of rebates that will not be redeemed by customers based on historical experience of

such redemptions.

GAAP requires that activation fees charged with the sale of equipment and service be allocated to the

equipment and service based upon the relative selling prices of each item. Device activation fees

charged at agent locations, where U.S. Cellular does not also sell a wireless device to the customer, are

deferred and recognized over the average device life. Device activation fees charged as a result of

handset sales at Company-owned retail stores are recognized at the time the handset is delivered to the

customer.

ETC revenues recognized in the reporting period represent the amounts which U.S. Cellular is entitled to

receive for such period, as determined and approved in connection with U.S. Cellular’s designation as an

ETC in various states.

44