US Cellular 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

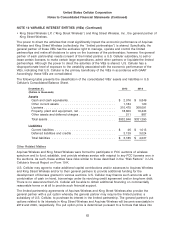

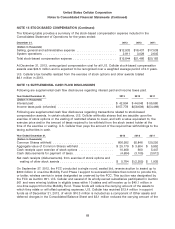

NOTE 15 STOCK-BASED COMPENSATION (Continued)

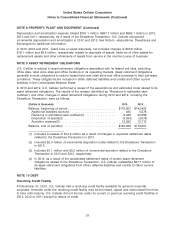

A summary of U.S. Cellular nonvested restricted stock units at December 31, 2013 and changes during

the year then ended is presented in the table below:

Weighted

Average

Grant Date

Common Restricted Stock Units Number Fair Value

Nonvested at December 31, 2012 ...................... 1,139,000 $38.40

Granted ....................................... 601,000 32.06

Vested ........................................ (238,000) 42.26

Forfeited ...................................... (332,000) 35.63

Nonvested at December 31, 2013 ...................... 1,170,000 $36.46

The total fair value of restricted stock units that vested during 2013, 2012 and 2011 was $8.8 million,

$8.9 million and $9.5 million, respectively, as of the respective vesting dates. The weighted average grant

date fair value of restricted stock units granted in 2013, 2012 and 2011 was $32.06, $34.09 and $42.33,

respectively.

Long-Term Incentive Plans—Deferred Compensation Stock Units—Certain U.S. Cellular employees may

elect to defer receipt of all or a portion of their annual bonuses and to receive a company matching

contribution on the amount deferred. All bonus compensation that is deferred by employees electing to

participate is immediately vested and is deemed to be invested in U.S. Cellular Common Share stock

units. The amount of U.S. Cellular’s matching contribution depends on the portion of the annual bonus

that is deferred. Participants receive a 25% match for amounts deferred up to 50% of their total annual

bonus and a 33% match for amounts that exceed 50% of their total annual bonus; such matching

contributions also are deemed to be invested in U.S. Cellular Common Share stock units.

The total fair value of deferred compensation stock units that vested was less than $0.1 million during

2013, 2012 and 2011. The weighted average grant date fair value of deferred compensation stock units

granted in 2013, 2012 and 2011 was $31.50, $36.34 and $41.79, respectively. As of December 31, 2013,

there were 12,000 vested but unissued deferred compensation stock units valued at $0.5 million.

Compensation of Non-Employee Directors—U.S. Cellular issued 13,000, 7,600 and 6,600 Common

Shares in 2013, 2012 and 2011, respectively, under its Non-Employee Director compensation plan.

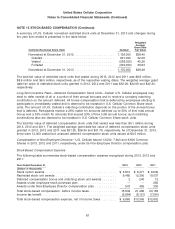

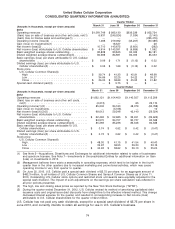

Stock-Based Compensation Expense

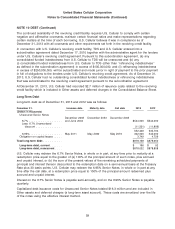

The following table summarizes stock-based compensation expense recognized during 2013, 2012 and

2011:

Year Ended December 31, 2013 2012 2011

(Dollars in thousands)

Stock option awards ....................................... $ 5,810 $ 8,471 $ 9,549

Restricted stock unit awards ................................. 9,485 12,300 10,037

Deferred compensation bonus and matching stock unit awards ........ 2 240 12

Awards under employee stock purchase plan ..................... — — 255

Awards under Non-Employee Director compensation plan ............ 547 455 330

Total stock-based compensation, before income taxes ............... 15,844 21,466 20,183

Income tax benefit ........................................ (5,984) (8,121) (7,581)

Total stock-based compensation expense, net of income taxes ........ $ 9,860 $13,345 $12,602

67