US Cellular 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

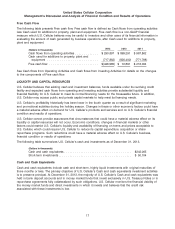

Short-term and Long-term Investments

Short-term investments consist of U.S. Treasury Notes which are designated as held-to-maturity investments

and are recorded at amortized cost in the Consolidated Balance Sheet. For these investments, U.S. Cellular’s

objective is to earn a higher rate of return on funds that are not anticipated to be required to meet liquidity

needs in the near term, while maintaining a low level of investment risk. See Note 2—Fair Value

Measurements in the Notes to Consolidated Financial Statements for additional information on Short-term

investments. As of December 31, 2013, U.S. Cellular does not hold Long-term investments.

Revolving Credit Facility

U.S. Cellular has a revolving credit facility available for general corporate purposes.

In connection with U.S. Cellular’s revolving credit facility, TDS and U.S. Cellular entered into a subordination

agreement dated December 17, 2010 together with the administrative agent for the lenders under U.S.

Cellular’s revolving credit facility. At December 31, 2013, no U.S. Cellular debt was subordinated pursuant to

this subordination agreement.

U.S. Cellular’s interest cost on its revolving credit facility is subject to increase if its current credit rating from

nationally recognized credit rating agencies is lowered, and is subject to decrease if the rating is raised. The

credit facility would not cease to be available nor would the maturity date accelerate solely as a result of a

downgrade in U.S. Cellular’s credit rating. However, a downgrade in U.S. Cellular’s credit rating could

adversely affect its ability to renew the credit facility or obtain access to other credit facilities in the future.

As of December 31, 2013, U.S. Cellular’s senior debt credit rating from nationally recognized credit rating

agencies remained at investment grade.

In June 2013, U.S. Cellular provided $17.4 million in letters of credit to the FCC in connection with U.S.

Cellular’s winning bids in Auction 901. See Note 16—Supplemental Cash Flow Disclosures in the Notes to

Consolidated Financial Statements for additional information on Auction 901.

The continued availability of the revolving credit facility requires U.S. Cellular to comply with certain negative

and affirmative covenants, maintain certain financial ratios and make representations regarding certain

matters at the time of each borrowing. The covenants also prescribe certain terms associated with

intercompany loans from TDS or TDS subsidiaries to U.S. Cellular or U.S. Cellular subsidiaries. There were

no intercompany loans at December 31, 2013 or 2012. U.S. Cellular believes that it was in compliance as of

December 31, 2013 with all of the financial covenants and requirements set forth in its revolving credit facility.

See Note 10—Debt in the Notes to Consolidated Financial Statements for additional information regarding

the revolving credit facility.

Long-Term Financing

U.S. Cellular’s long-term debt indentures do not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a downgrade

in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt financing in the future.

U.S. Cellular believes that it was in compliance as of December 31, 2013 with all financial covenants and

other requirements set forth in its long-term debt indentures. U.S. Cellular has not failed to make nor does it

expect to fail to make any scheduled payment of principal or interest under such indentures.

The long-term debt principal payments due for the next four years represent less than 1% of the total

long-term debt obligation at December 31, 2013. Refer to Market Risk—Long-Term Debt for additional

information regarding required principal payments and the weighted average interest rates related to U.S.

Cellular’s Long-term debt.

U.S. Cellular, at its discretion, may from time to time seek to retire or purchase its outstanding debt through

cash purchases and/or exchanges for other securities, in open market purchases, privately negotiated

18