US Cellular 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

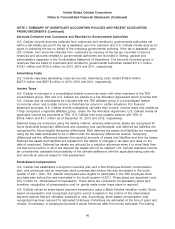

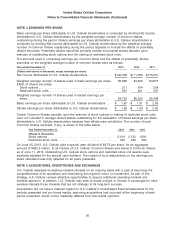

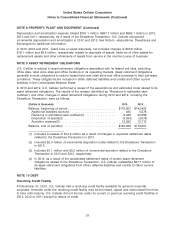

NOTE 4 EARNINGS PER SHARE

Basic earnings per share attributable to U.S. Cellular shareholders is computed by dividing Net income

attributable to U.S. Cellular shareholders by the weighted average number of common shares

outstanding during the period. Diluted earnings per share attributable to U.S. Cellular shareholders is

computed by dividing Net income attributable to U.S. Cellular shareholders by the weighted average

number of common shares outstanding during the period adjusted to include the effects of potentially

dilutive securities. Potentially dilutive securities primarily include incremental shares issuable upon

exercise of outstanding stock options and the vesting of restricted stock units.

The amounts used in computing earnings per common share and the effects of potentially dilutive

securities on the weighted average number of common shares were as follows:

Year ended December 31, 2013 2012 2011

(Dollars and shares in thousands, except earnings per share)

Net income attributable to U.S. Cellular shareholders ............. $140,038 $111,006 $175,041

Weighted average number of shares used in basic earnings per share 83,968 84,645 84,877

Effect of dilutive securities:

Stock options ........................................ 211 184 224

Restricted stock units .................................. 551 401 347

Weighted average number of shares used in diluted earnings per

share .............................................. 84,730 85,230 85,448

Basic earnings per share attributable to U.S. Cellular shareholders . . . $ 1.67 $ 1.31 $ 2.06

Diluted earnings per share attributable to U.S. Cellular shareholders . . $ 1.65 $ 1.30 $ 2.05

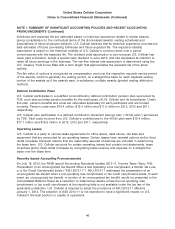

Certain Common Shares issuable upon the exercise of stock options or vesting of restricted stock units

were not included in average diluted shares outstanding for the calculation of Diluted earnings per share

attributable to U.S. Cellular shareholders because their effects were antidilutive. The number of such

Common Shares excluded, if any, is shown in the table below.

Year Ended December 31, 2013 2012 2011

(Shares in thousands)

Stock options .................................... 2,010 2,123 1,591

Restricted stock units ............................... 190 369 250

On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate

amount of $482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common Shares

as of June 11, 2013. Outstanding U.S. Cellular stock options and restricted stock unit awards were

equitably adjusted for the special cash dividend. The impact of such adjustments on the earnings per

share calculation was fully reflected for all years presented.

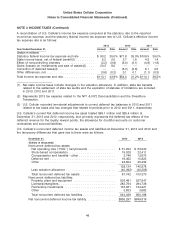

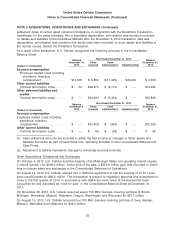

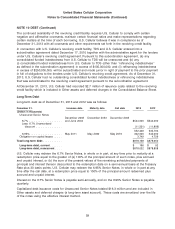

NOTE 5 ACQUISITIONS, DIVESTITURES AND EXCHANGES

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on investment. As part of this

strategy, U.S. Cellular reviews attractive opportunities to acquire additional operating markets and

wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for other

wireless interests those interests that are not strategic to its long-term success.

Acquisitions did not have a material impact on U.S. Cellular’s consolidated financial statements for the

periods presented and pro forma results, assuming acquisitions had occurred at the beginning of each

period presented, would not be materially different from the results reported.

50