US Cellular 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

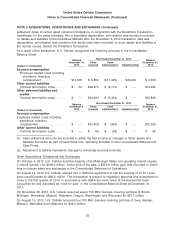

NOTE 5 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

On March 14, 2012, U.S. Cellular sold the majority of the assets and liabilities of a wireless market for

$49.8 million in cash. At the time of the sale, a $4.2 million gain was recorded in (Gain) loss on sale of

business and other exit costs, net in the Consolidated Statement of Operations. On May 9, 2011,

pursuant to certain required terms of the partnership agreement, U.S. Cellular paid $24.6 million in cash

to purchase the remaining ownership interest in this wireless market in which it previously held a 49%

noncontrolling interest. In connection with the acquisition of the remaining interest, a $13.4 million gain

was recorded to adjust the carrying value of this 49% investment to its fair value of $25.7 million based

on an income approach valuation method. The gain was recorded in Gain (loss) on investments in the

Consolidated Statement of Operations in 2011.

On September 30, 2011, U.S. Cellular completed an exchange whereby U.S. Cellular received eighteen

700 MHz spectrum licenses covering portions of Idaho, Illinois, Indiana, Kansas, Nebraska, Oregon and

Washington in exchange for two PCS spectrum licenses covering portions of Illinois and Indiana. The

exchange of licenses provided U.S. Cellular with additional spectrum to meet anticipated future capacity

and coverage requirements in several of its markets. No cash, customers, network assets, other assets

or liabilities were included in the exchange. As a result of this transaction, U.S. Cellular recognized a gain

of $11.8 million, representing the difference between the fair value of the licenses received, calculated

using a market approach valuation method, and the carrying value of the licenses surrendered. This gain

was recorded in (Gain) loss on license sales and exchanges in the Consolidated Statement of

Operations for the year ended December 31, 2011.

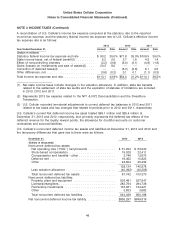

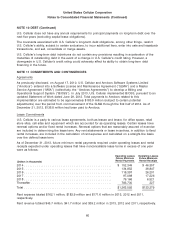

U.S. Cellular acquisitions in 2013 and 2012 and the allocation of the purchase price for these

acquisitions were as follows:

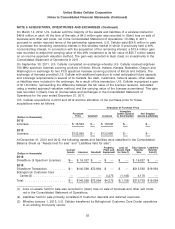

Allocation of Purchase Price

Intangible

Purchase Assets Subject Net Tangible

Price Goodwill Licenses to Amortization Assets/(Liabilities)

(Dollars in thousands)

2013

Licenses ...................... $ 16,540 $— $ 16,540 $— $—

2012

Licenses ...................... $122,690 $— $122,690 $— $—

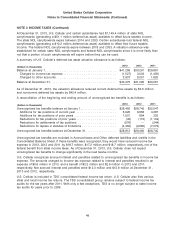

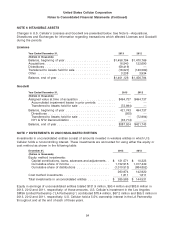

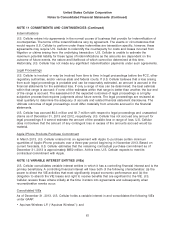

At December 31, 2013 and 2012, the following assets and liabilities were classified in the Consolidated

Balance Sheet as ‘‘Assets held for sale’’ and ‘‘Liabilities held for sale’’:

Property, Loss on Total Assets Liabilities

Current Plant and Assets Held Held for Held for

Assets Licenses Goodwill Equipment for Sale(1) Sale Sale(2)

(Dollars in thousands)

2013

Divestiture of Spectrum Licenses . . $— $ 16,027 $ — $ — $ — $ 16,027 $ —

2012

Divestiture Transaction .......... $— $140,599 $72,994 $ — $ — $213,593 $19,594

Bolingbrook Customer Care

Center(3) .................. — — — 4,275 (1,105) 3,170 —

Total ....................... $— $140,599 $72,994 $4,275 $(1,105) $216,763 $19,594

(1) Loss on assets held for sale was recorded in (Gain) loss on sale of business and other exit costs,

net in the Consolidated Statement of Operations.

(2) Liabilities held for sale primarily consisted of Customer deposits and deferred revenues.

(3) Effective January 1, 2013, U.S. Cellular transferred its Bolingbrook Customer Care Center operations

to an existing third party vendor.

53