US Cellular 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

transactions, tender offers, exchange offers or otherwise. Such repurchases or exchanges, if any, will depend

on prevailing market conditions, liquidity requirements, contractual restrictions and other factors. The

amounts involved may be material.

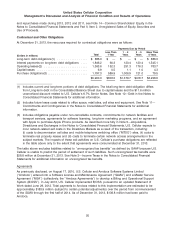

U.S. Cellular has an effective shelf registration statement on Form S-3 to issue senior or subordinated debt

securities. The proceeds from any such issuance may be used for general corporate purposes, including: the

possible reduction of other long-term debt; in connection with acquisition, construction and development

programs; the reduction of short-term debt; for working capital; to provide additional investments in

subsidiaries; or the repurchase of shares. The U.S. Cellular shelf registration statement permits U.S. Cellular

to issue at any time and from time to time senior or subordinated debt securities in one or more offerings up

to an aggregate principal amount of $500 million. The ability of U.S. Cellular to complete an offering pursuant

to such shelf registration statement is subject to market conditions and other factors at the time.

See Note 10—Debt in the Notes to Consolidated Financial Statements for additional information on

Long-term financing.

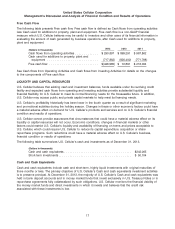

Capital Expenditures

U.S. Cellular’s capital expenditures for 2014 are expected to be approximately $640 million. These

expenditures are expected to be for the following general purposes:

• Expand and enhance network coverage in its service areas, including providing additional capacity to

accommodate increased network usage, principally data usage, by current customers;

• Continue to deploy 4G LTE technology in certain markets;

• Expand and enhance the retail store network; and

• Develop and enhance office systems.

U.S. Cellular plans to finance its capital expenditures program for 2014 using primarily Cash flows from

operating activities and, as necessary, existing cash balances and short-term investments.

Acquisitions, Divestitures and Exchanges

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on investment. As part of this strategy,

U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets and wireless

spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for other wireless

interests those interests that are not strategic to its long-term success. As a result, U.S. Cellular may be

engaged from time to time in negotiations relating to the acquisition, divestiture or exchange of companies,

properties or wireless spectrum. In general, U.S. Cellular may not disclose such transactions until there is a

definitive agreement. See Note 5—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated

Financial Statements for additional information related to significant transactions.

Variable Interest Entities

U.S. Cellular consolidates certain entities because they are ‘‘variable interest entities’’ under accounting

principles generally accepted in the United States of America (‘‘GAAP’’). See Note 12—Variable Interest

Entities in the Notes to Consolidated Financial Statements for additional information related to these variable

interest entities. U.S. Cellular may elect to make additional capital contributions and/or advances to these

variable interest entities in future periods in order to fund their operations.

Common Share Repurchase Program

In the past year, U.S. Cellular has repurchased and expects to continue to repurchase its Common Shares,

subject to its repurchase program. For additional information related to the current repurchase authorization

19