UPS 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 UPS Annual Report 2004

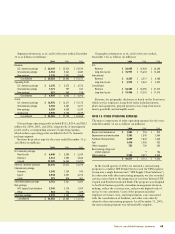

NOTE 17. QUARTERLY INFORMATION (UNAUDITED)

First Quarter Second Quarter Third Quarter Fourth Quarter

2004 2003 2004 2003 2004 2003 2004 2003

Revenue:

U.S. domestic package $ 6,540 $ 6,020 $ 6,480 $ 6,124 $ 6,494 $ 6,219 $ 7,096 $ 6,659

International package 1,619 1,302 1,613 1,371 1,666 1,370 1,864 1,518

Non-package 760 693 778 731 792 723 880 755

Total revenue 8,919 8,015 8,871 8,226 8,952 8,312 9,840 8,932

Operating profit:

U.S. domestic package 831 704 892 832 857 825 765 911

International package 269 134 272 158 262 176 318 241

Non-package 117 107 146 90 139 146 121 121

Total operating profit 1,217 945 1,310 1,080 1,258 1,147 1,204 1,273

Net income $ 759 $ 611 $ 818 $ 692 $ 890 $ 739 $ 866 $ 856

Earnings per share:

Basic $ 0.67 $ 0.54 $ 0.73 $ 0.61 $ 0.79 $ 0.66 $ 0.77 $ 0.76

Diluted $ 0.67 $ 0.54 $ 0.72 $ 0.61 $ 0.78 $ 0.65 $ 0.76 $ 0.75

First quarter 2003 net income reflects a charge for an impairment of investments ($37 million after-tax, $0.03 per diluted share)

and a credit to tax expense upon the resolution of various tax contingencies ($55 million, $0.05 per diluted share). Second quarter

2003 net income was impacted by the gain on the sale of Mail Technologies ($14 million after-tax, $0.01 per diluted share). Third

quarter 2003 net income reflects the gain on sale of Aviation Technologies ($15 million after-tax, $0.01 per diluted share) and the

credit to tax expense from a favorable ruling on the tax treatment of jet engine maintenance costs ($22 million, $0.02 per diluted

share). Fourth quarter 2003 net income was impacted by a gain on the redemption of long-term debt ($18 million after-tax, $0.02

per diluted share) and a credit to income tax expense for a lower effective state tax rate ($39 million, $0.03 per diluted share).

Third quarter 2004 net income includes a credit to tax expense ($99 million, $0.09 per diluted share) related to the resolution of

various tax matters. Fourth quarter 2004 net income includes an impairment charge ($70 million after-tax, $0.06 per diluted share)

on Boeing 727, 747, and McDonnell Douglas DC-8 aircraft, and related engines and parts, and a charge to pension expense ($40 mil-

lion after-tax, $0.04 per diluted share) resulting from the consolidation of data collection systems. Fourth quarter 2004 net income

also includes credits to income tax expense ($43 million, $0.04 per diluted share) related to various items, including the resolution of

certain tax matters, the removal of a portion of the valuation allowances on certain deferred tax assets on net operating loss carryfor-

wards, and an adjustment for identified tax contingency items.

Notes to consolidated financial statements