UPS 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated financial statements 43

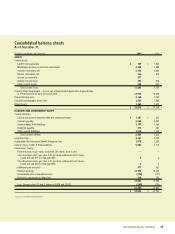

Consolidated balance sheets

As of December 31,

(In millions, except per share amounts) 2004 2003

ASSETS

Current Assets:

Cash & cash equivalents $ 739 $ 1,064

Marketable securities & short-term investments 4,458 2,888

Accounts receivable, net 5,156 4,004

Finance receivables, net 524 840

Income tax receivable 371 —

Deferred income taxes 392 316

Other current assets 965 847

Total Current Assets 12,605 9,959

Property, Plant & Equipment — at cost, net of accumulated depreciation & amortization

of $13,505 and $12,516 in 2004 and 2003 13,973 13,298

Prepaid Pension Costs 3,160 2,922

Goodwill and Intangible Assets, Net 1,924 1,883

Other Assets 1,364 1,672

$ 33,026 $29,734

LIABILITIES AND SHAREOWNERS’ EQUITY

Current Liabilities:

Current maturities of long-term debt and commercial paper $ 1,187 $ 674

Accounts payable 2,266 2,003

Accrued wages & withholdings 1,197 1,166

Dividends payable 315 282

Other current liabilities 1,518 1,499

Total Current Liabilities 6,483 5,624

Long-Term Debt 3,261 3,149

Accumulated Postretirement Benefit Obligation, Net 1,516 1,335

Deferred Taxes, Credits & Other Liabilities 5,382 4,774

Shareowners’ Equity:

Preferred stock, no par value, authorized 200 shares, none issued ——

Class A common stock, par value $.01 per share, authorized 4,600 shares,

issued 515 and 571 in 2004 and 2003 56

Class B common stock, par value $.01 per share, authorized 5,600 shares,

issued 614 and 560 in 2004 and 2003 65

Additional paid-in capital 417 662

Retained earnings 16,192 14,356

Accumulated other comprehensive loss (236) (177)

Deferred compensation obligations 169 136

16,553 14,988

Less: Treasury stock (3 and 2 shares in 2004 and 2003) (169) (136)

16,384 14,852

$ 33,026 $29,734

See notes to consolidated financial statements.