UPS 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 UPS Annual Report 2004

Notes to consolidated financial statements

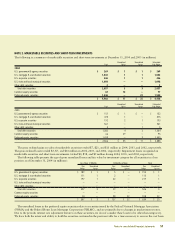

NOTE 8. LONG-TERM DEBT AND COMMITMENTS

Long-term debt, as of December 31, consists of the following (in millions):

2004 2003

8.38% debentures, due April 1, 2020 (i) $ 463 $ 444

8.38% debentures, due April 1, 2030 (i) 276 276

Commercial paper (ii) 1,015 544

Industrial development bonds, Philadelphia Airport facilities, due December 1, 2015 (iii) 100 100

Special facilities revenue bonds, Louisville Airport facilities, due January 1, 2029 (iv) 149 149

Floating rate senior notes (v) 441 441

Capitalized lease obligations (vi) 401 451

UPS Notes (vii) 393 419

5.50% Pound Sterling notes, due February 12, 2031 961 887

4.50% Singapore Dollar notes, due November 11, 2004 — 59

Special facilities revenue bonds, Dayton, OH facilities (viii) 121 —

Installment notes, mortgages, and bonds at various rates 128 53

4,448 3,823

Less current maturities (1,187) (674)

$ 3,261 $ 3,149

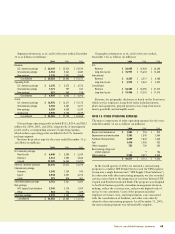

(i) On January 22, 1998, we exchanged $276 million of an original $700 million in debentures for new debentures of equal principal with a maturity of April 1, 2030. The new debentures have the same

interest rate as the 8.38% debentures due 2020 until April 1, 2020, and, thereafter, the interest rate will be 7.62% for the final 10 years. The 2030 debentures are redeemable in whole or in part at our

option at any time. The redemption price is equal to the greater of 100% of the principal amount and accrued interest or the sum of the present values of the remaining scheduled payout of principal and

interest thereon discounted to the date of redemption at a benchmark treasury yield plus five basis points plus accrued interest. The remaining $424 million of 2020 debentures are not subject to redemp-

tion prior to maturity. Interest is payable semiannually on the first of April and October for both debentures and neither debenture is subject to sinking fund requirements.

(ii) The weighted average interest rate on the commercial paper outstanding as of December 31, 2004 and 2003, was 2.10% and 0.96%, respectively. At December 31, 2004 and 2003, the entire com-

mercial paper balance has been classified as a current liability. The amount of commercial paper outstanding in 2005 is expected to fluctuate. We are authorized to borrow up to $7.0 billion under the

two commercial paper programs we maintain as of December 31, 2004.

(iii) The industrial development bonds bear interest at a daily variable rate. The average interest rates for 2004 and 2003 were 1.08% and 0.89%, respectively.

(iv) The special facilities revenue bonds bear interest at a daily variable rate. The average interest rates for 2004 and 2003 were 1.20% and 1.02%, respectively.

(v) The floating rate senior notes bear interest at one-month LIBOR less 45 basis points. The average interest rates for 2004 and 2003 were 1.00% and 0.78%, respectively. These notes are callable at vari-

ous times after 30 years at a stated percentage of par value, and putable by the note holders at various times after 10 years at a stated percentage of par value. The notes have maturities ranging from

2049 through 2053.

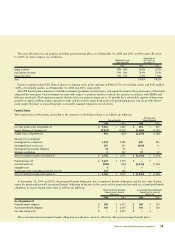

(vi) We have certain aircraft subject to capital leases. Some of the obligations associated with these capital leases have been legally defeased. The recorded value of aircraft subject to capital leases, which

are included in Property, Plant and Equipment is as follows as of December 31 (in millions):

2004 2003

Aircraft $ 1,795 $ 1,474

Accumulated amortization (257) (198)

$ 1,538 $ 1,276

(vii) The UPS Notes program involves the periodic issuance of fixed rate notes in $1,000 increments with various terms and maturities. At December 31, 2004, the coupon rates of the outstanding notes

varied between 3.00% and 6.20%, and the interest payments are made either monthly, quarterly or semiannually. The maturities of the notes range from 2006 to 2024. Substantially all of the fixed

obligations associated with the notes were swapped to floating rates, based on different LIBOR indices plus or minus a spread. The average interest rate payable on the swaps for 2004 and 2003 was

1.13% and 0.81%, respectively.

(viii) The special facilities revenue bonds were assumed in the acquisition of Menlo Worldwide Forwarding in December 2004 (see Note 7). The bonds have a par value of $108 million, $62 million of which

is due in 2009, while the remaining $46 million is due in 2018. The bonds due in 2018 are callable beginning in 2008. The bonds due in 2018 bear interest at a fixed rate of 5.63%, while the bonds

due in 2009 bear interest at fixed rates ranging from 6.05% to 6.20%. The bonds were recorded at fair value on the date of acquisition.

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and maturities, the fair

value of long-term debt, including current maturities, is approximately $4.708 and $4.109 billion as of December 31, 2004 and 2003,

respectively.

We lease certain aircraft, facilities, equipment and vehicles under operating leases, which expire at various dates through 2054.

Certain of the leases contain escalation clauses and renewal or purchase options. Rent expense related to our operating leases was

$693, $678 and $685 million for 2004, 2003 and 2002, respectively.