UPS 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 UPS Annual Report 2004

Notes to consolidated financial statements

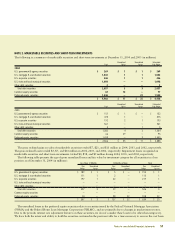

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in millions):

Pension Benefits Other Benefits

Employer Contributions:

2005 (expected) to plan trusts $ 723 $ 62

2005 (expected) to plan participants 756

Expected Benefit Payments:

2005 $ 214 $ 126

2006 257 133

2007 266 141

2008 303 150

2009 332 158

2010 - 2014 2,363 975

Expected benefit payments for pensions will be primarily paid from plan trusts. Expected benefit payments for postretirement bene-

fits will be paid from plan trusts and corporate assets.

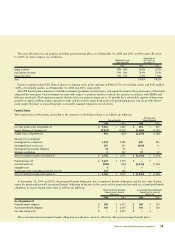

Net Periodic Benefit Cost

Information about net periodic benefit cost for the pension and postretirement benefit plans is as follows (in millions):

Postretirement

Pension Benefits Medical Benefits

2004 2003 2002 2004 2003 2002

Net Periodic Cost:

Service cost$332 $282 $217 $91 $79 $63

Interest cost 521 465 413 164 148 134

Expected return on assets (800) (669) (654) (34) (29) (33)

Amortization of:

Transition obligation 68 8 — — —

Prior service cost 37 37 30 — 1(1)

Actuarial (gain) loss 119 28 4 30 15 4

Net periodic benefit cost (benefit) $ 215 $ 151 $ 18 $ 251 $ 214 $ 167

Weighted average assumptions used to determine net cost:

Discount rate 6.25% 6.75% 7.50% 6.25% 6.75% 7.50%

Rate of compensation increase 4.00% 4.00% 4.00% N/A N/A N/A

Expected return on plan assets 8.96% 9.21% 9.42% 9.00% 9.25% 9.50%