UPS 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements 53

NOTE 5. EMPLOYEE BENEFIT PLANS

We maintain the following defined benefit pension plans (the “Plans”): UPS Retirement Plan, UPS Excess Coordinating Benefit Plan,

and the UPS Pension Plan.

The UPS Retirement Plan is noncontributory and includes substantially all eligible employees of participating domestic subsidiaries

who are not members of a collective bargaining unit. The Plan provides for retirement benefits based on average compensation levels

earned by employees prior to retirement. Benefits payable under this Plan are subject to maximum compensation limits and the

annual benefit limits for a tax qualified defined benefit plan as prescribed by the Internal Revenue Service.

The UPS Excess Coordinating Benefit Plan is a non-qualified plan that provides benefits to participants in the UPS Retirement Plan

for amounts that exceed the benefit limits described above.

The UPS Pension Plan is noncontributory and includes certain eligible employees of participating domestic subsidiaries and mem-

bers of collective bargaining units that elect to participate in the plan. The Plan provides for retirement benefits based on service

credits earned by employees prior to retirement.

Our funding policy is consistent with relevant federal tax regulations. Accordingly, our contributions are deductible for federal

income tax purposes. Because the UPS Excess Coordinating Benefit Plan is non-qualified for federal income tax purposes, this plan is

not funded.

We also sponsor postretirement medical plans that provide health care benefits to our retirees who meet certain eligibility require-

ments and who are not otherwise covered by multi-employer plans. Generally, this includes employees with at least 10 years of service

who have reached age 55 and employees who are eligible for postretirement medical benefits from a Company-sponsored plan pur-

suant to collective bargaining agreements. We have the right to modify or terminate certain of these plans. In many cases, these

benefits have been provided to retirees on a noncontributory basis; however, in certain cases, retirees are required to contribute

toward the cost of the coverage.

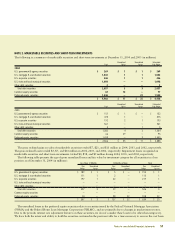

Benefit Obligations

The following table provides a reconciliation of the changes in the plans’ benefit obligations as of September 30 (in millions):

Postretirement

Pension Benefits Medical Benefits

2004 2003 2004 2003

Net benefit obligation at October 1, prior year $ 8,092 $ 6,670 $ 2,592 $ 2,149

Service cost 332 282 91 79

Interest cost 521 465 164 148

Plan participants’ contributions — — 96

Plan amendments 33(115) (22)

Acquired businesses — — 46 —

Actuarial (gain) loss290 876 36 337

Gross benefits paid (201) (204) (129) (105)

Net benefit obligation at September 30 $ 9,037 $ 8,092 $ 2,694 $ 2,592

Weighted-average assumptions used to determine benefit obligations:

Discount rate 6.25% 6.25% 6.25% 6.25%

Rate of annual increase in future compensation levels 4.00% 4.00% N/A N/A