UPS 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements 59

The acquisition had no material effect on our results of opera-

tions in 2004.

We are in the process of finalizing the independent appraisals

for certain assets and liabilities to assist management in allocat-

ing the Menlo purchase price to the individual assets acquired

and liabilities assumed. This may result in adjustments to the

carrying values of Menlo’s recorded assets and liabilities, includ-

ing the amount of any residual value allocated to goodwill. We

are also completing our analysis of integration plans that may

result in additional purchase price adjustments. The preliminary

allocation of the purchase price included in the current period

balance sheet is based on the current best estimates of manage-

ment and is subject to revision based on final determination of

fair values of acquired assets and assumed liabilities. We antici-

pate the valuations and other studies will be completed prior to

the anniversary date of the acquisition.

In February 2005, we announced our intention to transfer

operations currently taking place at the Menlo facility in

Dayton, Ohio to other UPS facilities over approximately 12 to

18 months. This action is being taken to remove redundancies

between the Menlo and existing UPS transportation networks,

and thus provide efficiencies and better leverage the current UPS

facilities in the movement of air freight. We are currently evalu-

ating our plans for this facility, including potential alternate uses

or closure. As a result, we anticipate possibly incurring costs

related to employee severance, lease terminations, fixed asset

impairments, and related items. Depending upon the nature of

these costs, some of these items could result in charges to

expense, while other items could result in adjustments to the

purchase price allocation. We are in process of finalizing our

plan for this facility, and therefore the purchase price allocation

does not reflect liability accruals or fair value adjustments that

may result from this decision.

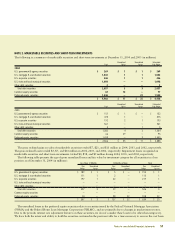

The preliminary allocation of the total purchase price of Menlo resulted in the following condensed balance sheet of assets acquired

and liabilities assumed as of December 31, 2004 (in millions):

Assets Liabilities

Cash and cash equivalents $ 47 Accounts payable $ 28

Accounts receivable 466 Accrued wages and withholdings 104

Other current assets 21 Other current liabilities 161

Property, plant, and equipment 141 Long-term debt 124

Goodwill and intangible assets 26 Deferred Taxes, Credits and Other Liabilities 45

Other assets 4Accumulated postretirement benefit obligation 46

$ 705 $ 508

In December 2004, we announced an agreement with Sinotrans to acquire direct control of the international express operations in

23 cities within China, and to purchase Sinotrans’ interest in our current joint venture in China. The agreement requires a payment of

$100 million to Sinotrans in 2005, which can be increased or decreased based on certain contingent factors. The acquisition will be

completed in stages throughout 2005. In February 2005, we took direct control of operations in five locations, while the additional

18 locations will be acquired by December 2005. The operations being acquired will be reported within our International package

reporting segment.

In February 2005, we announced an agreement to acquire Messenger Service Stolica S.A., one of the leading parcel and express

delivery companies in Poland. Stolica offers customers a full suite of domestic delivery services, and had 2004 revenue of approximately

$64 million. Upon completion of the transaction, which is expected in the second quarter of 2005, Stolica will be included in our

International package reporting segment.