UPS 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements 57

The expected return on plan assets assumption was developed using various market assumptions in combination with the plans’

asset allocations and active investment management. These assumptions and allocations were evaluated using input from a third-party

consultant and various pension plan asset managers, including their review of asset class return expectations and long-term inflation

assumptions. The 10-year U.S. Treasury yield is the foundation for all other market assumptions, and various risk premiums are

added to determine the expected return for each allocation. As of our September 30, 2004 measurement date, it was projected that the

funds could achieve an 8.96% net return over time, using the plans’ asset allocations and active management strategy.

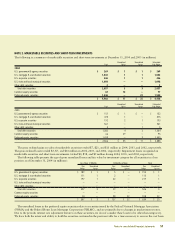

Assumed health care cost trends have a significant effect on the amounts reported for the postretirement medical plans. A one-

percent change in assumed health care cost trend rates would have the following effects (in millions):

1% Increase 1% Decrease

Effect on total of service cost and interest cost $ 5 $ (5)

Other Plans

We also contribute to several multi-employer pension plans for which the previous disclosure information is not determinable.

Amounts charged to operations for pension contributions to these multi-employer plans were $1.163, $1.066, and $1.028 billion

during 2004, 2003, and 2002, respectively.

We also contribute to several multi-employer health and welfare plans that cover both active and retired employees for which the

previous disclosure information is not determinable. Amounts charged to operations for contributions to multi-employer health and

welfare plans were $761, $691, and $604 million during 2004, 2003, and 2002, respectively.

We also sponsor a defined contribution plan for all employees not covered under collective bargaining agreements. The Company

matches, in shares of UPS common stock, a portion of the participating employees’ contributions. Matching contributions charged to

expense were $94, $87, and $79 million for 2004, 2003, and 2002, respectively.

In the fourth quarter of 2002, our vacation policy for non-union employees was amended to require that vacation pay be earned

ratably throughout the year. Previously, an employee became vested in the full year of vacation pay at the beginning of each year. As a

result of this policy change, a credit to compensation and benefits of $197 million was taken in the fourth quarter to reduce the

vacation pay liability as of December 31, 2002.

NOTE 6. GOODWILL, INTANGIBLES, AND OTHER ASSETS

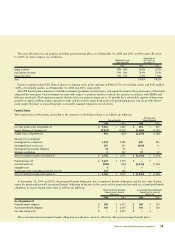

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic International

Package Package Non-Package Consolidated

December 31, 2002 balance $ — $ 102 $ 968 $ 1,070

Acquired — — 30 30

Impaired — — — —

Currency/Other — (2) 75 73

December 31, 2003 balance— 100 1,073 1,173

Acquired — 41 38 79

Impaired — — — —

Currency/Other — —33

December 31, 2004 balance $ — $ 141 $ 1,114 $ 1,255

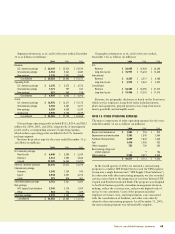

The goodwill acquired in the Non-package segment during 2004 resulted primarily from the purchase of Menlo Worldwide

Forwarding. The purchase price allocation for this acquisition was not complete as of December 31, 2004, therefore we anticipate

that future purchase price adjustments may change the amount allocated to goodwill. The goodwill acquired in the International

package segment during 2004 resulted from the purchase of the remaining minority interest in UPS Yamato Express Co. (See Note 7

for further discussion of these acquisitions). The currency/other balance in the Non-package segment includes escrow reimbursements

and the resolution of other pre-acquisition contingencies from acquisitions completed prior to 2004.