UPS 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 UPS Annual Report 2004

Notes to consolidated financial statements

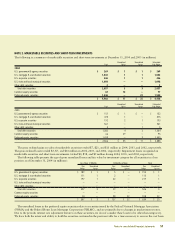

The following is a summary of intangible assets at December 31, 2004 and 2003 (in millions):

Trademarks, Intangible Total

Licenses, Patents, Franchise Capitalized Pension Intangible

and Other Rights Software Asset Assets

December 31, 2004:

Gross carrying amount $ 29 $ 97 $ 1,249 $ 4 $ 1,379

Accumulated amortization (16) (18) (676) — (710)

Net carrying value $ 13 $ 79 $ 573 $ 4 $ 669

December 31, 2003:

Gross carrying amount $ 30 $ 88 $ 1,101 $ 5 $ 1,224

Accumulated amortization (10) (13) (491) — (514)

Net carrying value $20 $ 75 $ 610 $ 5 $ 710

Amortization of intangible assets was $221, $196, and $129 million during 2004, 2003 and 2002, respectively. Expected amortiza-

tion of finite-lived intangible assets recorded as of December 31, 2004 for the next five years is as follows (in millions):

2005 — $198; 2006 — $198; 2007 — $198; 2008 — $12; 2009 — $11. Amortization expense in future periods will be affected by

business acquisitions, software development and other factors.

Other assets as of December 31 consist of the following (in millions):

2004 2003

Non-current finance receivables, net of allowance for credit losses $ 475 $ 574

Other non-current assets 889 1,098

$ 1,364 $ 1,672

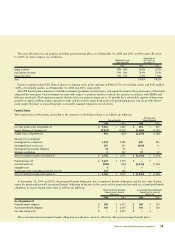

NOTE 7. BUSINESS ACQUISITIONS AND DISPOSITIONS

We regularly explore opportunities to make acquisitions that

would enhance our package delivery business and our various

non-package businesses. During the three years ended December

31, 2004, we completed several acquisitions, including both

domestic and international transactions, which were accounted

for under the purchase method of accounting. In connection with

the foregoing transactions, we paid cash (net of cash acquired) in

the aggregate amount of $238, $30, and $14 million in 2004,

2003, and 2002, respectively. Pro forma results of operations

have not been presented for any of the acquisitions because the

effects of these transactions were not material on either an indi-

vidual or aggregate basis. The results of operations of each

acquired company are included in our statements of consolidated

income from the date of acquisition. The purchase price alloca-

tions of acquired companies can be modified up to one year after

the date of acquisition, however we generally expect such adjust-

ments to the purchase price allocations to be immaterial.

During the second quarter of 2003, we sold our Mail

Technologies business unit in a transaction that increased net

income by $14 million, or $0.01 per diluted share. The gain con-

sisted of a pre-tax loss of $24 million recorded in other operating

expenses within the non-package segment, and a tax benefit of

$38 million recognized in conjunction with the sale. The tax ben-

efit exceeded the pre-tax loss from this sale primarily because the

goodwill impairment charge we previously recorded for the Mail

Technologies business unit was not deductible for income tax

purposes. Consequently, our tax basis was greater than our book

basis, thus producing the tax benefit described above.

During the third quarter of 2003, we sold our Aviation

Technologies business unit and recognized a pre-tax gain of $24

million ($15 million after-tax, or $0.01 per diluted share), which

was recorded in other operating expenses within the non-package

segment. The operating results of both the Mail Technologies unit

and the Aviation Technologies unit were previously included in

our non-package segment, and were not material to our consoli-

dated operating results in any of the periods presented.

In March 2004, we acquired the remaining 49% minority

interest in UPS Yamato Express Co., which was previously a

joint venture with Yamato Transport Co. in Japan, for $65 mil-

lion in cash. UPS Yamato Express provides express package

delivery services in Japan. Upon the close of the acquisition, UPS

Yamato Express became a wholly-owned subsidiary of UPS. The

acquisition had no material effect on our financial condition or

results of operations.

In December 2004, we acquired the Menlo Worldwide

Forwarding unit from CNF Inc. for $150 million in cash (net of

cash acquired) plus the assumption of $110 million in par value

of debt and capital lease obligations. Menlo Worldwide

Forwarding is a global freight forwarder that provides a full

suite of heavy air freight forwarding services, ocean services and

international trade management, including customs brokerage.