UPS 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 UPS Annual Report 2004

Management’s discussion and analysis of financial condition and results of operations

In August 2003, we filed a $2.0 billion shelf registration state-

ment under which we may issue debt securities in the United

States. There was approximately $126 million issued under this

shelf registration statement at December 31, 2004, all of which

consists of issuances under our UPS Notes program.

Our existing debt instruments and credit facilities do not have

cross-default or ratings triggers, however these debt instruments

and credit facilities do subject us to certain financial covenants.

These covenants generally require us to maintain a $3.0 billion

minimum net worth and limit the amount of secured indebtedness

available to the company. These covenants are not considered

material to the overall financial condition of the company, and all

covenant tests were passed as of December 31, 2004.

Commitments

We have contractual obligations and commitments in the form

of operating leases, capital leases, debt obligations and purchase

commitments. We intend to satisfy these obligations through the

use of cash flow from operations. The following table summa-

rizes our contractual obligations and commitments as of

December 31, 2004 (in millions):

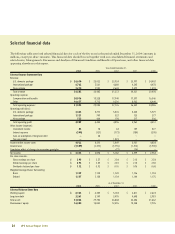

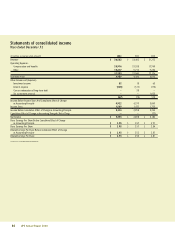

Capitalized Operating Debt Purchase

Year Leases Leases Principal Commitments

2005 $ 97 $ 370 $ 1,110 $ 1,012

2006 70 327 6 488

2007 121 242 — 223

2008 132 169 27 274

2009 76 128 84 637

After 2009 62 590 2,777 1,129

Total $558 $ 1,826 $ 4,004 $ 3,763

In December 2004, we amended our existing aircraft purchase

agreement with Airbus Industries. The amended agreement will

reduce Airbus A300-600 aircraft on order from 50 to 13, and

the number of options on this aircraft from 37 to zero. These 13

aircraft remaining on order will be delivered to UPS by July

2006. Additionally, we placed a firm order for 10 Airbus A380

freighter aircraft, and obtained options to purchase 10 addi-

tional A380 aircraft. The Airbus A380 aircraft will be delivered

to UPS between 2009 and 2012. The purchase commitments

information above reflects the amended agreement.

In January 2005, we also announced an agreement to pur-

chase an additional 11 Boeing MD-11 pre-owned aircraft. These

aircraft will be delivered to UPS between 2005 and 2007.

We believe that funds from operations and borrowing pro-

grams will provide adequate sources of liquidity and capital

resources to meet our expected long-term needs for the operation

of our business, including anticipated capital expenditures, such

as commitments for aircraft purchases, for the foreseeable future.

Contingencies

On August 9, 1999 the United States Tax Court held that we

were liable for tax on income of Overseas Partners Ltd., a

Bermuda company that had reinsured excess value (“EV”) insur-

ance purchased by our customers beginning in 1984, and that we

were liable for additional tax for the 1983 and 1984 tax years.

The IRS took similar positions to those advanced in the Tax

Court decision for tax years subsequent to 1984 through 1998.

On June 20, 2001, the U.S. Court of Appeals for the Eleventh

Circuit ruled in our favor and reversed the Tax Court decision. In

January 2003, we and the IRS finalized settlement of all out-

standing tax issues related to EV package insurance. Under the

terms of settlement, we agreed to adjustments that will result in

income tax due of approximately $562 million, additions to tax

of $60 million and related interest. The amount due to the IRS as

a result of the settlement is less than amounts we previously had

accrued. As a result, we recorded income, before taxes, of $1.023

billion ($776 million after tax) during the fourth quarter of 2002.

In the first quarter of 2004, we received a refund of $185 million

pertaining to the 1983 and 1984 tax years.

The IRS had proposed adjustments, unrelated to the EV pack-

age insurance matters discussed above, regarding the allowance

of deductions and certain losses, the characterization of expenses

as capital rather than ordinary, the treatment of certain income,

and our entitlement to tax credits in the 1985 through 1998 tax

years. In the third quarter of 2004, we settled all outstanding

issues related to each of the tax years 1991 through 1998. In the

fourth quarter of 2004, we received a refund of $425 million

pertaining to the 1991 through 1998 tax years. We expect to

receive the $371 million of refunds related to the 1985 through

1990 tax years within the next six months.

The IRS may take similar positions with respect to some of

the non-EV package insurance matters for each of the years

1999 through 2004. If challenged, we expect that we will prevail

on substantially all of these issues. Specifically, we believe that

our practice of expensing the items that the IRS alleges should

have been capitalized is consistent with the practices of other

industry participants. We believe that the eventual resolution of

these issues will not have a material adverse effect on our finan-

cial condition, results of operations or liquidity.

We were named as a defendant in twenty-three now-dismissed

lawsuits that sought to hold us liable for the collection of premiums

for EV insurance in connection with package shipments since 1984.

Based on state and federal tort, contract and statutory claims, these

cases generally claimed that we failed to remit collected EV premi-

ums to an independent insurer; we failed to provide promised EV

insurance; we acted as an insurer without complying with state

insurance laws and regulations; and the price for EV insurance was

excessive. These actions were all filed after the August 9, 1999 U.S.

Tax Court decision, discussed above, which the U.S. Court of

Appeals for the Eleventh Circuit later reversed.