UPS 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements 69

Derivatives Not Designated As Hedges

Derivatives not designated as hedges primarily consist of a small

portfolio of stock warrants in public and private companies that

are held for investment purposes. These warrants are recorded at

fair value, and the impact of these warrants on our results was

immaterial for 2004, 2003 and 2002.

Income Effects of Derivatives

In the context of hedging relationships, “effectiveness” refers to

the degree to which fair value changes in the hedging instrument

offset corresponding changes in the hedged item. Certain ele-

ments of hedge positions cannot qualify for hedge accounting

under FAS 133 whether effective or not, and must therefore be

marked to market through income. Both the effective and inef-

fective portions of gains and losses on hedges are reported in the

income statement category related to the hedged exposure. Both

the ineffective portion of hedge positions and the elements

excluded from the measure of effectiveness were immaterial for

2004, 2003 and 2002.

As of December 31, 2004, $13 million in losses related to cash

flow hedges that are currently deferred in OCI are expected to be

reclassified to income over the 12 month period ending December

31, 2005. The actual amounts that will be reclassified to income

over the next 12 months will vary from this amount as a result of

changes in market conditions. No amounts were reclassified to

income during 2004 in connection with forecasted transactions

that were no longer considered probable of occurring.

At December 31, 2004, the maximum term of derivative

instruments that hedge forecasted transactions, except those

related to cross-currency interest rate swaps on existing financial

instruments, was three years. We maintain cross-currency inter-

est rate swaps that extend through 2009.

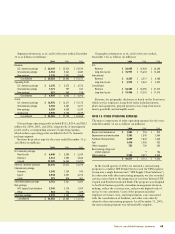

Fair Value of Financial Instruments

At December 31, 2004 and 2003, our financial instruments

included cash and cash equivalents, marketable securities and

short-term investments, accounts receivable, finance receivables,

accounts payable, short-term and long-term borrowings, and

commodity, interest rate, foreign currency, and equity options,

forwards, and swaps. The fair values of cash and cash equiva-

lents, accounts receivable, and accounts payable approximate

carrying values because of the short-term nature of these instru-

ments. The fair value of our marketable securities and short-term

investments is disclosed in Note 2, finance receivables in Note 3,

and debt instruments in Note 8.