UPS 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ATLANTA, GEORGIA 7:24 A.M.

Chairman and

Chief Executive Officer

We believe that prevailing global economic

conditions provide a framework for continued

growth in the United States and abroad for both

the small package and supply chain operations.

In fact, we expect to sustain the earnings growth

track record we’ve established over the last three

decades. Throughout that timeframe, earnings

have increased at a compounded annual rate of

over 15 percent.

Our unique, integrated global business model

is critical to our success. UPS is the only company

in our industry that has one operating network

for all types of shipments: domestic, international,

air, ground, commercial, residential. This makes

for economies of scope and scale that improve

operating efficiency as well as customer service.

In addition, the UPS culture is based on the

owner/management philosophy through which

over 30,000 active management employees have

significant investments in UPS stock. A large

percentage of our full-time nonmanagement

employees also maintain ownership positions in

UPS. This breeds a decision-making mentality

that’s long-term in focus, centered on achieving

strong returns on invested capital, and a work ethic

that’s characterized by dedication. Having “skin in

the game” is a great motivator to align employee

interests with public shareowners’ interests.

As a result, we generate consistent, superior

returns, and are in excellent financial condition.

UPS is one of only a handful of companies with a

AAA credit rating from both Standard & Poor’s

and Moody’s. At the end of 2004, we had cash

and investments of almost $5.2 billion.

Our strong financial position enables us to

reinvest in the business to enhance our operations,

improve service, add new products, and expand our

geographic presence. It also enables us to increase

shareowner value through an on-going share

repurchase program and regular dividend increases

— up 22 percent in 2004 and 65 percent since 2000.

Going forward here’s what you can expect

from UPS in 2005 and beyond. We will:

n Manage our entire business enterprise to

preserve the consistency in revenue and

earnings growth that we’ve established

over the years;

n Grow our market share in the global small

package business;

n Increase operating profit in each of our three

key businesses: U.S. domestic, international,

and supply chain;

n And do this while maintaining a sustainable

approach to running our business that

considers the social, environmental, and

economic consequences of our business practices.

As we enter 2005, business is moving to the

tempo of an expanding global economy. UPS is

ideally positioned to thrive in this environment

every minute around the world.

Michael L. Eskew

Chairman and

Chief Executive Officer

*International Monetary Fund World Outlook

**World Bank

*** McKinsey and Company

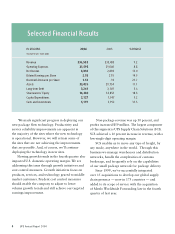

We made significant progress in deploying our

new package flow technology. Productivity and

service reliability improvements are apparent in

the majority of the sites where the new technology

is operational. However, we will retrain some of

the sites that are not achieving the improvements

that are possible. And, of course, we’ll continue

deploying the technology in new sites.

Slowing growth trends in the fourth quarter also

impacted U.S. domestic operating margin. We are

addressing this issue through growth initiatives and

cost control measures. Growth initiatives focus on

products, services, and technology geared to middle-

market customers. Prudent cost control measures

should enable the company to adjust to lower

volume growth trends and still achieve our targeted

earnings improvement.

Non-package revenue was up 10 percent, and

profits increased $59 million. The largest component

of this segment is UPS Supply Chain Solutions (SCS).

SCS achieved a 10 percent increase in revenue, with a

low-single-digit operating margin.

SCS enables us to move any type of freight, by

any mode, anywhere in the world. Through this

business we manage warehouses and distribution

networks, handle the complexities of customs

brokerage, and frequently rely on the capabilities

of our small package network for package delivery.

Since 1999, we’ve successfully integrated

over 15 acquisitions to develop our global supply

chain presence — now in 175 countries — and

added to its scope of service with the acquisition

of Menlo Worldwide Forwarding late in the fourth

quarter of last year.