UPS 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 UPS Annual Report 2004

Notes to consolidated financial statements

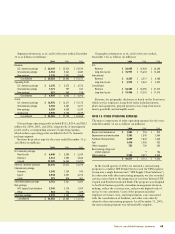

NOTE 14. INCOME TAXES

The income tax expense (benefit) for the years ended December 31

consists of the following (in millions):

2004 2003 2002

Current:

U.S. Federal $ 1,675 $ 1,103 $ 1,208

U.S. State & Local 71 112 148

Non-U.S.98 86 62

Total Current 1,844 1,301 1,418

Deferred:

U.S. Federal (155) 181 323

U.S. State & Local (84) (11) 14

Non-U.S. (16) 1—

Total Deferred (255) 171 337

Total $ 1,589 $ 1,472 $ 1,755

Income before income taxes includes income of foreign sub-

sidiaries of $270, $237, and $16 million in 2004, 2003, and

2002, respectively.

A reconciliation of the statutory federal income tax rate to the

effective income tax rate for the years ended December 31 con-

sists of the following:

2004 2003 2002

Statutory U.S. federal

income tax rate 35.0% 35.0% 35.0%

U.S. state & local income

taxes (net of federal benefit) 1.2 1.5 2.1

Tax assessment reversal

(tax portion) — — (2.8)

Other (3.9) (2.8) 0.7

Effective income tax rate 32.3% 33.7% 35.0%

During the third quarter of 2004, we recognized a $99 million

reduction of income tax expense related to the favorable settle-

ment of various U.S. federal tax contingency matters with the

IRS pertaining to tax years 1985 through 1998, and various

state and non-U.S. tax contingency matters.

During the fourth quarter of 2004, we recognized a $109 mil-

lion reduction of income tax expense primarily related to the

favorable resolution of a U.S. state tax contingency matter,

improvements in U.S. state and non-U.S. effective tax rates, and

the reversal of valuation allowances associated with certain U.S.

state & local and non-U.S. net operating loss and credit carry-

forwards due to sufficient positive evidence that the related

subsidiaries will be profitable and generate taxable income

before such carryforwards expire.

During the first quarter of 2003, we recognized a $55 million

reduction of income tax expense due to the favorable resolution

of several outstanding contingency matters with the IRS. During

the third quarter of 2003, we recognized a $22 million credit to

income tax expense as a result of a favorable tax court ruling in

relation to an outstanding contingency matter with the IRS.

After filing our 2002 state tax returns during the fourth

quarter of 2003, we completed a review of the taxability of our

operations in various U.S. state taxing jurisdictions and the

effects of available state tax credits. As a result of this review,

we recorded a decrease of $39 million in the income tax provi-

sion in the fourth quarter of 2003. This decrease includes a

reduction in our estimated state tax liabilities and the effect of

the estimated state income tax effective rate applied to our

temporary differences.

Deferred tax liabilities and assets are comprised of the follow-

ing at December 31 (in millions):

2004 2003

Property, plant and equipment $ 2,624 $ 2,453

Goodwill and intangible assets 428 349

Pension plans 1,481 1,266

Other 167 473

Gross deferred tax liabilities 4,700 4,541

Other postretirement benefits 684 588

Loss carryforwards (non-U.S. and state) 113 117

Insurance reserves 469 347

Vacation pay accrual 145 131

Other 471 673

Gross deferred tax assets 1,882 1,856

Deferred tax assets valuation allowance (64) (117)

Net deferred tax assets 1,818 1,739

Net deferred tax liability 2,882 2,802

Current deferred tax asset (392) (316)

Long-term liability — see Note 9 $ 3,274 $ 3,118

The valuation allowance increased (decreased) by $(53), $25

and $23 million during the years ended December 31, 2004,

2003 and 2002, respectively. We reclassified $719 million from

deferred income taxes to other non-current assets as of

December 31, 2003. This amount represents various income tax

receivable items that had previously been netted against our

deferred tax liabilities.

As of December 31, 2004, we have U.S. state & local operating

loss and credit carryforwards of approximately $428 million and

$25 million, respectively. The operating loss carryforwards expire

at varying dates through 2024. The majority of the credit carry-

forwards may be carried forward indefinitely. We also have