UPS 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 UPS Annual Report 2004

Notes to consolidated financial statements

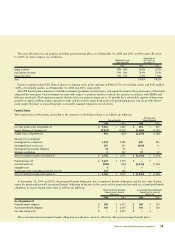

The accumulated benefit obligation for our pension plans as

of September 30, 2004 and 2003 was $8.113 and $7.325 billion,

respectively. We use a measurement date of September 30 for our

pension and postretirement benefit plans.

In December 2003, the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (the “Act”) was

enacted. The Act established a prescription drug benefit under

Medicare, known as “Medicare Part D”, and a federal subsidy

to sponsors of retiree health care plans that provide a benefit

that is at least actuarially equivalent to Medicare Part D. We

believe that benefits provided to certain participants will be at

least actuarially equivalent to Medicare Part D, and, accordingly

may be entitled to a subsidy.

In May 2004, the FASB issued FSP 106-2, which requires (a)

that the effects of the federal subsidy be considered an actuarial

gain and recognized in the same manner as other actuarial gains

and losses and (b) certain disclosures for employers that sponsor

postretirement health care plans that provide prescription drug

benefits. We determined the effects of the Act were not a signifi-

cant event requiring an interim remeasurement under FAS 106.

Consequently, as permitted by FSP 106-2, net periodic benefit

cost for 2004 does not reflect the effects of the Act. The accumu-

lated postretirement benefit obligation (APBO) was remeasured

as of September 30, 2004 to reflect the effects of the Act, which

resulted in an immaterial reduction in the APBO and expected

net employer benefit payments.

Future postretirement medical benefit costs were forecasted

assuming an initial annual increase of 9.0%, decreasing to 5.0%

by the year 2009 and with consistent annual increases at those

ultimate levels thereafter.

Assumed health care cost trends have a significant effect on

the amounts reported for the postretirement medical plans. A

one-percent change in assumed health care cost trend rates

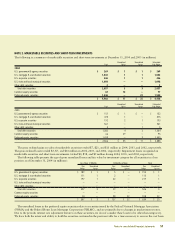

would have the following effects (in millions):

1% Increase 1% Decrease

Effect on postretirement benefit obligation $ 69 $ (75)

Because the UPS Excess Coordinating Plan is not funded, the

Company has recorded an additional minimum pension liability

for this plan of $91 and $105 million at December 31, 2004 and

2003, respectively. This liability is included in the other credits

and non-current liabilities portion of Note 9. As of December

31, 2004 and 2003, the Company has recorded an intangible

asset of $4 and $5 million, respectively, representing the net

unrecognized prior service cost for this plan. A total of $55 and

$63 million at December 31, 2004 and 2003, respectively, were

recorded as a reduction of other comprehensive income in share-

owners’ equity (net of the tax effect of $32 and $37 million,

respectively). The unfunded accumulated benefit obligation of

the UPS Excess Coordinating Benefit Plan was $160 and $154

million as of December 31, 2004 and 2003, respectively.

Additionally, we maintain several non-U.S. defined benefit

pension plans. As of December 31, 2004, we have recorded a

prepaid pension asset of $5 million, an additional minimum pen-

sion liability of $30 million, and a $20 million (net of the tax

effect of $11 million) reduction of other comprehensive income

in shareowners’ equity. The impact of these non-U.S. plans is not

material to our operating results or financial position.

Plan Assets

The following table provides a reconciliation of the changes in the plans’ assets as of September 30 (in millions):

Postretirement

Pension Benefits Medical Benefits

2004 2003 2004 2003

Fair value of plan assets at October 1, prior year $ 7,823 $ 6,494 $ 409 $ 337

Actual return on plan assets 1,140 1,143 51 47

Employer contributions 1,200 390 115 124

Plan participants’ contributions — — 96

Gross benefits paid (201) (204) (129) (105)

Fair value of plan assets at September 30 $ 9,962 $ 7,823 $ 455 $ 409

Employer contributions and benefits paid under the pension plans include $6 million and $5 million paid from employer assets in

2004 and 2003, respectively. Employer contributions and benefits paid (net of participant contributions) under the postretirement

medical benefit plans include $57 and $45 million paid from employer assets in 2004 and 2003, respectively.