UPS 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 UPS Annual Report 2004

Notes to consolidated financial statements

recoverable based on the undiscounted future cash flows of the

asset. If the carrying amount of the asset is determined not to be

recoverable, a write-down to fair value is recorded. Fair values are

determined based on quoted market values, discounted cash flows,

or external appraisals, as applicable. We review long-lived assets

for impairment at the individual asset or the asset group level for

which the lowest level of independent cash flows can be identified.

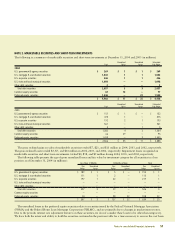

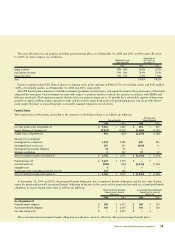

In December 2003, we permanently removed from service a

number of Boeing 727 and McDonnell Douglas DC-8 aircraft.

As a result, we conducted an impairment evaluation, which

resulted in a $75 million impairment charge during the fourth

quarter for these aircraft (including the related engines), $69 mil-

lion of which impacted the U.S. domestic package segment and

$6 million of which impacted the international package segment.

In December 2004, we permanently removed from service a

number of Boeing 727, 747 and McDonnell Douglas DC-8 air-

craft. As a result of the actual and planned retirement of these

aircraft, we conducted an impairment evaluation, which resulted

in a $110 million impairment charge during the fourth quarter for

these aircraft (including the related engines and parts), $91 million

of which impacted the U.S. domestic package segment and $19

million of which impacted the international package segment.

These charges are classified in the caption “other expenses”

within other operating expenses (see Note 13). UPS continues to

operate all of its other aircraft and continues to experience posi-

tive cash flow.

Goodwill and Intangible Assets

Costs of purchased businesses in excess of net assets acquired

(goodwill), and intangible assets are accounted for under the

provisions of FASB Statement No. 142 “Goodwill and Other

Intangible Assets” (“FAS 142”). Upon adoption of FAS 142, we

were required to test all existing goodwill for impairment as of

January 1, 2002, and at least annually thereafter, unless changes

in circumstances indicate an impairment may have occurred

sooner. We are required to test goodwill on a “reporting unit”

basis. A reporting unit is the operating segment unless, for busi-

nesses within that operating segment, discrete financial

information is prepared and regularly reviewed by management,

in which case such a component business is the reporting unit.

A fair value approach is used to test goodwill for impairment.

An impairment charge is recognized for the amount, if any, by

which the carrying amount of goodwill exceeds its fair value.

Fair values are established using discounted cash flows. When

available and as appropriate, comparative market multiples were

used to corroborate discounted cash flow results.

We recorded a non-cash goodwill impairment charge of $72

million ($0.06 per diluted share) as of January 1, 2002, related

to our Mail Technologies business. This charge was reported as

a cumulative effect of a change in accounting principle. The pri-

mary factor resulting in the impairment charge was the lower

than anticipated growth experienced in the expedited mail deliv-

ery business. In conjunction with our annual test of goodwill in

2002, we recorded an additional impairment charge of $2 mil-

lion related to our Mail Technologies business, resulting in total

goodwill impairment of $74 million for 2002. We sold the Mail

Technologies business unit during the second quarter of 2003

(see Note 7). Our annual impairment tests performed in 2004

and 2003 resulted in no goodwill impairment.

Finite-lived intangible assets, including trademarks, licenses,

patents, and franchise rights are amortized over the estimated

useful lives of the assets, which range from 5 to 20 years.

Capitalized software is amortized over periods ranging from 3 to

5 years. In 2004, we began classifying software as intangible

assets. Previously, capitalized software was classified within prop-

erty, plant and equipment. Capitalized software at December 31,

2003 totaling $610 million was reclassified from property, plant

and equipment into intangible assets for consistent presentation

on our consolidated balance sheet.

Self-Insurance Accruals

We self-insure costs associated with workers’ compensation

claims, automotive liability, health and welfare, and general

business liabilities, up to certain limits. Insurance reserves are

established for estimates of the loss that we will ultimately incur

on reported claims, as well as estimates of claims that have been

incurred but not yet reported. Recorded balances are based on

reserve levels determined by outside actuaries, who incorporate

historical loss experience and judgments about the present and

expected levels of cost per claim.

Income Taxes

Income taxes are accounted for under FASB Statement No. 109,

“Accounting for Income Taxes” (“FAS 109”). FAS 109 is an

asset and liability approach that requires the recognition of

deferred tax assets and liabilities for the expected future tax

consequences of events that have been recognized in our finan-

cial statements or tax returns. In estimating future tax

consequences, FAS 109 generally considers all expected future

events other than proposed changes in the tax law or rates.

Valuation allowances are provided if it is more likely than not

that a deferred tax asset will not be realized.

We record accruals for tax contingencies related to potential

assessments by tax authorities. Such accruals are based on man-

agement’s judgment and best estimate as to the ultimate outcome

of any potential tax audits. Actual tax audit results could vary

from these estimates.