UPS 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 UPS Annual Report 2004

Management’s discussion and analysis of financial condition and results of operations

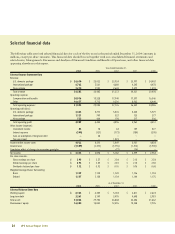

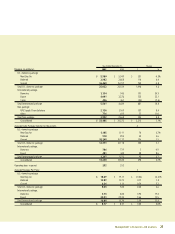

Operating Profit

The following tables set forth information showing the change in operating profit, both in dollars (in millions) and in percentage terms:

Year Ended December 31, Change

2004 2003 $ %

Operating Segment

U.S. domestic package $ 3,345 $ 3,272 $ 73 2.2%

International package 1,121 709 412 58.1

Non-package 523 464 59 12.7

Consolidated Operating Profit $ 4,989 $ 4,445 $ 544 12.2%

Year Ended December 31, Change

2003 2002 $ %

Operating Segment

U.S. domestic package $ 3,272 $ 3,576 $ (304) (8.5)%

International package 709 322 387 120.2

Non-package 464 198 266 134.3

Consolidated Operating Profit $ 4,445 $ 4,096 $ 349 8.5%

U.S. Domestic Package Operations

2004 compared to 2003

U.S. domestic package revenue increased $1.588 billion, or 6.3%,

for the year, which resulted from a 3.3% increase in average daily

package volume and a 2.1% increase in revenue per piece.

Ground volume increased 4.0% during the year, driven in part by

the improving U.S. economy, and reflects growth in both com-

mercial and residential deliveries. Ground volume increased 4.8%

during the first nine months of the year, but slowed to 1.5% dur-

ing the fourth quarter. Total Next Day Air volume (up 0.8%) and

total deferred volume (down 0.9%) were both significantly

affected by declines in letter volume, but offset by an increase in

Next Day Air package volume. The 2004 decline in Next Day Air

and deferred letter volume is largely due to the slowdown in

mortgage refinancing, which was notably strong in 2003.

Ground revenue per piece increased 0.9% for the year prima-

rily due to the impact of a rate increase that took effect in 2004,

but growth was adversely impacted by approximately 220 basis

points due to the removal of the fuel surcharge on ground prod-

ucts, as discussed below. Next Day Air revenue per piece

increased 6.6%, while deferred revenue per piece increased

6.1%, primarily due to the shift in product mix from letters to

packages, the rate increase, and the modified fuel surcharge on

domestic air products.

On January 5, 2004, a rate increase took effect which was in

line with previous years’ rate increases. We increased rates for

standard ground shipments an average of 1.9% for commercial

deliveries. The ground residential surcharge increased $0.25 to

$1.40 over the commercial ground rate. An additional delivery

area surcharge of $1.00 was implemented for commercial deliv-

eries in certain ZIP codes. Rates for UPS Hundredweight

increased 5.9%. In addition, we increased rates for UPS Next

Day Air an average of 2.9% and increased rates for deferred

services by 2.9%.

In addition, we discontinued the fuel surcharge on ground

products, while we began to apply a new indexed surcharge to

domestic air products. This indexed fuel surcharge for the

domestic air products is based on the U.S. Energy Department’s

Gulf Coast spot price for a gallon of kerosene-type jet fuel.

Based on published rates, the average fuel surcharge applied to

our air products during 2004 was 7.07%, compared with the

average surcharge of 1.47% applied to both air and ground

products in 2003, resulting in an increase in domestic fuel sur-

charge revenue of $290 million during the year.

U.S. domestic package operating profit increased $73 million,

or 2.2%, primarily due to the increase in volume and revenue

growth discussed previously, but somewhat offset by increased

aircraft impairment charges ($91 million in 2004 compared to

$69 million in 2003) and a $63 million pension charge related to

the consolidation of data systems used to collect and accumulate

plan participant data.