UPS 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements 67

non-U.S. loss carryforwards of approximately $874 million as of

December 31, 2004, the majority of which may be carried for-

ward indefinitely. As indicated in the table above, we have

established a valuation allowance for certain non-U.S. and state

loss carryforwards, due to the uncertainty resulting from a lack

of previous taxable income within the applicable tax jurisdictions.

Undistributed earnings of our non-U.S. subsidiaries amounted

to approximately $728 million at December 31, 2004. Those

earnings are considered to be indefinitely reinvested and, accord-

ingly, no U.S. federal or state deferred income taxes have been

provided thereon. Upon distribution of those earnings in the

form of dividends or otherwise, we would be subject to U.S.

income taxes and withholding taxes payable in various non-U.S.

jurisdictions, which could potentially be offset by foreign tax

credits. Determination of the amount of unrecognized deferred

U.S. income tax liability is not practicable because of the com-

plexities associated with its hypothetical calculation.

We have not changed our position with respect to the indefi-

nite reinvestment of foreign earnings to take into account the

possible election of the repatriation provisions contained in the

American Jobs Creation Act of 2004. The American Jobs

Creation Act of 2004 (the “Jobs Act”), as enacted on October

22, 2004, provides for a temporary 85% dividends received

deduction on certain foreign earnings repatriated during a one-

year period. The deduction would result in an approximate

5.25% U.S. federal tax rate on any repatriated earnings. To

qualify for the deduction, the earnings must be reinvested in the

United States pursuant to a domestic reinvestment plan estab-

lished by the Company’s Chief Executive Officer and approved

by the Company’s Board of Directors. Certain other criteria in

the Jobs Act must be satisfied as well. The maximum amount of

our foreign earnings that qualify for the temporary deduction

under the Jobs Act is $500 million.

We are in the process of evaluating whether we will repatri-

ate foreign earnings under the repatriation provisions of the

Jobs Act, and if so, the amount that will be repatriated. We are

considering repatriating any amount up to $500 million under

the Jobs Act. We are awaiting the issuance of further regulatory

guidance and passage of statutory technical corrections with

respect to certain provisions in the Jobs Act prior to determin-

ing the amounts we could repatriate. We expect to determine

the amounts and sources of foreign earnings to be repatriated,

if any, during the fourth quarter of 2005. We cannot reasonably

estimate the impact of a qualifying repatriation, should we

choose to make one, on our income tax expense for 2005 at

this time.

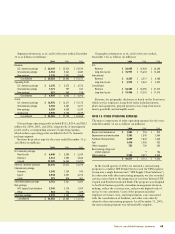

NOTE 15. EARNINGS PER SHARE

The following table sets forth the computation of basic and

diluted earnings per share (in millions except per share

amounts):

2004 2003 2002

Numerator:

Net income before the

cumulative effect of change

in accounting principle $ 3,333 $ 2,898 $ 3,254

Denominator:

Weighted average shares 1,125 1,125 1,117

Management incentive awards 111

Deferred compensation

obligations 322

Denominator for basic

earnings per share 1,129 1,128 1,120

Effect of dilutive securities:

Management incentive awards 444

Stock option plans 4610

Denominator for diluted

earnings per share1,137 1,138 1,134

Basic earnings per share before

cumulative effect of change

in accounting principle $ 2.95 $ 2.57 $ 2.91

Diluted earnings per share

before cumulative effect

of change in accounting

principle $ 2.93 $ 2.55 $ 2.87

Diluted earnings per share for the years ended December 31,

2004, 2003, and 2002 exclude the effect of 2.7, 2.9, and 0.1 mil-

lion shares, respectively, of common stock that may be issued

upon the exercise of employee stock options because such effect

would be antidilutive.