UPS 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

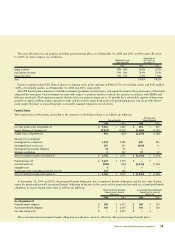

Consolidated financial statements 45

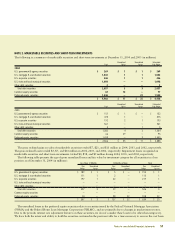

Statements of consolidated shareowners’ equity

Years Ended December 31,

2004 2003 2002

(In millions, except per share amounts) Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year 571 $ 6 642 $ 7 772 $ 8

Common stock purchases (12) — (5) — (10) —

Stock award plans 12 — 12 — 11 —

Common stock issuances 3— 2 — 2 —

Conversions of Class A to Class B common stock (59) (1) (80) (1) (133) (1)

Balance at end of year 515 5571 6 642 7

Class B Common Stock

Balance at beginning of year 560 5482 4349 3

Common stock purchases (5) — (2) — — —

Conversions of Class A to Class B common stock 59 1 80 1 133 1

Balance at end of year 614 6560 5482 4

Additional Paid-In Capital

Balance at beginning of year 662 387 414

Stock award plans 677 545 477

Common stock purchases (1,075) (398) (604)

Common stock issuances 153 128 100

Balance at end of year 417 662 387

Retained Earnings

Balance at beginning of year 14,356 12,495 10,162

Net income 3,333 2,898 3,182

Dividends ($1.12, $0.92, and $0.76) (1,262) (1,037) (849)

Common stock purchases (235) — —

Balance at end of year 16,192 14,356 12,495

Accumulated Other Comprehensive Income

Foreign currency translation adjustment:

Balance at beginning of year (56) (328) (269)

Aggregate adjustment for the year (71) 272 (59)

Balance at end of year (127) (56) (328)

Unrealized gain (loss) on marketable securities, net of tax:

Balance at beginning of year 14 (34) (21)

Current period changes in fair value (net of tax effect of $(10), $13, and $(9)) (18) 21 (16)

Reclassification to earnings (net of tax effect of $(1), $17, and $1) (1) 27 3

Balance at end of year (5) 14 (34)

Unrealized gain (loss) on cash flow hedges, net of tax:

Balance at beginning of year (72) (26) (49)

Current period changes in fair value (net of tax effect of $21, $(6), and $6) 37 (9) 10

Reclassification to earnings (net of tax effect of $4, $(21), and $9) 6(37) 13

Balance at end of year (29) (72) (26)

Additional minimum pension liability, net of tax:

Balance at beginning of year (63) (50) —

Minimum pension liability adjustment (net of tax effect of $(5), $(6), and $(31)) (12) (13) (50)

Balance at end of year (75) (63) (50)

Accumulated other comprehensive income at end of year (236) (177) (438)

Deferred Compensation Obligations

Balance at beginning of year 136 84 47

Common stock held for deferred compensation obligations 33 52 37

Balance at end of year 169 136 84

Treasury Stock

Balance at beginning of year (2) (136) (1) (84) (1) (47)

Common stock held for deferred compensation obligations (1) (33) (1) (52) — (37)

Balance at end of year (3) (169) (2) (136) (1) (84)

Total Shareowners’ Equity at End of Year $16,384 $14,852 $ 12,455

Comprehensive Income $ 3,274 $ 3,159 $ 3,083

See notes to consolidated financial statements.