UPS 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 UPS Annual Report 2004

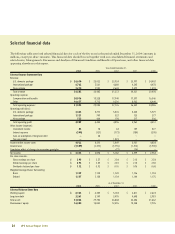

Management’s discussion and analysis of financial condition and results of operations

adversely affected by aircraft impairment charges of $19 million

in 2004, compared to a $6 million charge in 2003.

2003 compared to 2002

International package revenue improved $881 million, or 18.8%,

for the year due primarily to the 8.6% volume growth for our

export products and strong revenue per piece improvements, a

portion of which can be attributed to the impact of currency.

Revenue increased $443 million during the year due to currency

fluctuations. Export volume increased throughout the world, with

Asia-Pacific, Canada, and the Americas showing double-digit

export volume growth, and U.S. and European export volume

increasing slightly over 6%. European export volume growth was

adversely impacted by the strength of the Euro and the weak

European economy. Domestic volume increased 0.9% for the year,

reversing a 3.2% decline from the previous year, which was also

negatively affected by the weak European economy.

Export revenue per piece increased 12.5% for the year (3.3%

currency-adjusted), due to improvements in product mix and

continued focus on yield management. In total, international

average daily package volume increased 3.7% and average rev-

enue per piece increased 17.4% (6.2% currency-adjusted). The

7.6% decline in cargo revenue during the year was largely due

to a reduction of flights in our air network in the Americas.

Rates for international shipments originating in the United

States (UPS Worldwide Express, UPS Worldwide Express Plus,

UPS Worldwide Expedited and UPS Standard service) increased

an average of 3.9%. Rate changes for shipments originating out-

side the United States generally are made throughout the year

and vary by geographic market.

The improvement in operating profit for our international

package operations was $387 million for the year, $117 million

of which was due to favorable currency fluctuations. This

increase in operating profit was primarily due to the strong

export volume growth and revenue per piece increases described

previously. In 2002, international operating profit benefited

from an $11 million credit to operating expense as a result of a

change in our vacation policy for non-union employees.

Non-Package Operations

2004 compared to 2003

Non-package revenue increased $308 million, or 10.6%, for

the year. UPS Supply Chain Solutions increased revenue by

10.3% during the year, with strong growth in our air and

ground freight forwarding businesses, as well as our logistics

business. Favorable currency fluctuations provided $73 million

of the increase in revenue for the year. The remainder of our

non-package operations, which includes Mail Boxes Etc. (the

franchisor of Mail Boxes Etc. and The UPS Store), UPS Capital,

our mail and consulting services, and our excess value package

insurance business, increased revenue by 11.3% for the year,

largely due to strong double-digit franchise and royalty rev-

enue growth at Mail Boxes Etc. resulting from an expanding

store base, as well as higher excess value insurance revenue.

Menlo Worldwide Forwarding, which was acquired in

December 2004, added $33 million in revenue.

Non-package operating profit increased $59 million, or

12.7%, for the year, primarily due to improved results from our

UPS Capital, mail services, and excess value insurance business.

Mail Boxes Etc. experienced strong profit growth, due to the

increased franchise and royalty revenue noted previously. Non-

package operating profit includes $112 million (compared to

$114 million in 2003) of intersegment profit for the year, with

a corresponding amount of operating expense, which reduces

operating profit, in the U.S. domestic package segment.

During the second quarter of 2003, we sold our Mail

Technologies business unit in a transaction that increased net

income by $14 million, or $0.01 per diluted share. The gain con-

sisted of a pre-tax loss of $24 million recorded in other operating

expenses within the non-package segment, and a tax benefit of

$38 million recognized in conjunction with the sale. The tax ben-

efit exceeded the pre-tax loss from this sale primarily because the

goodwill impairment charge we previously recorded for the Mail

Technologies business unit was not deductible for income tax

purposes. Consequently, our tax basis was greater than our book

basis, thus producing the tax benefit described above.

During the third quarter of 2003, we sold our Aviation

Technologies business unit and recognized a pre-tax gain of $24

million ($15 million after-tax, or $0.01 per diluted share), which

is recorded in other operating expenses within the non-package

segment. The operating results of both the Mail Technologies

unit and the Aviation Technologies unit were previously included

in our non-package segment, and were not material to our con-

solidated operating results in any of the periods presented.

2003 compared to 2002

Non-package revenue increased $234 million, or 8.8%, for the

year. UPS Supply Chain Solutions increased revenue by 8.0%

during the year. This increase was due to growth in our supply

chain management and other logistics businesses, with interna-

tional revenues growing faster than in the United States, partially

as a result of favorable currency fluctuations. Favorable currency

fluctuations accounted for $74 million of the increase in rev-

enue. Freight forwarding revenue increased at a slower rate,

which was influenced by global economic conditions and

increased air revenue in 2002 as a result of the work disruption

at U.S. west coast ports. The remainder of our non-package

operations, which includes Mail Boxes Etc. (the franchisor of

Mail Boxes Etc. and The UPS Store), UPS Capital, our mail and

consulting services, and our excess value package insurance busi-

ness, increased revenue by 11.0% for the year, primarily due to