UPS 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 UPS Annual Report 2004

Management’s discussion and analysis of financial condition and results of operations

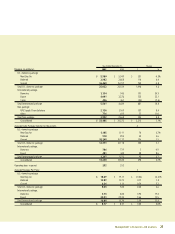

Investment Income/Interest Expense

2004 compared to 2003

Investment income increased by $64 million during the year,

primarily due to a $58 million impairment charge recognized

during 2003. We periodically review our investments for indica-

tions of other than temporary impairment considering many

factors, including the extent and duration to which a security’s

fair value has been less than its cost, overall economic and mar-

ket conditions, and the financial condition and specific prospects

for the issuer. During the first quarter of 2003, after considering

the continued decline in the U.S. equity markets, we recognized

an impairment charge of $58 million, primarily related to our

investment in S&P 500 equity portfolios. Investment income

also increased in 2004 due to higher interest rates earned on

cash balances, but was somewhat offset by increased equity-

method losses on certain investment partnerships.

The $28 million increase in interest expense during 2004 was

primarily due to the impact of higher interest rates on variable

rate debt and certain interest rate swaps, as well as the impact of

currency exchange rates and imputed interest expense associated

with certain investment partnerships. The impact of higher inter-

est rates was somewhat offset by lower average debt balances

outstanding in 2004 compared to 2003.

In December 2003, we redeemed $300 million in cash-settled

convertible senior notes at a price of 102.703, and also termi-

nated the swap transaction associated with the notes. The

redemption amount paid was lower than the amount recorded

for the fair value of the notes at the time of redemption, which,

along with the cash settlement received on the swap, resulted in

a $28 million non-operating gain recorded in 2003 results.

2003 compared to 2002

The decrease in investment income of $45 million in 2003 is

primarily due to the $58 million impairment charge recognized

during the first quarter of 2003. The $52 million decline in inter-

est expense in 2003 was primarily the result of lower commercial

paper balances outstanding, lower interest rates on variable rate

debt, and lower floating rates on interest rate swaps.

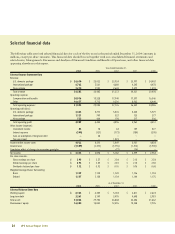

Net Income and Earnings Per Share

2004 compared to 2003

2004 net income was $3.333 billion, a 15.0% increase from the

$2.898 billion in 2003, resulting in an increase in diluted earn-

ings per share to $2.93 in 2004 from $2.55 in 2003. Net income

in 2004 was adversely impacted by a $70 million after-tax

impairment charge ($0.06 per diluted share) on Boeing 727,

747, and McDonnell Douglas DC-8 aircraft, engines, and parts,

as well as a $40 million after-tax charge ($0.04 per diluted

share) to pension expense resulting from the consolidation of

data systems used to collect and accumulate plan participant

data. Net income was positively impacted by credits to income

tax expense totaling $142 million ($0.13 per diluted share)

related to various items, including the resolution of certain tax

matters, the removal of a portion of the valuation allowance on

certain deferred tax assets on net operating loss carryforwards,

and an adjustment for identified tax contingency items.

Net income in 2003 was favorably impacted by the $14 mil-

lion after-tax gain ($0.01 per diluted share) on the sale of Mail

Technologies, the $15 million after-tax gain ($0.01 per diluted

share) on the sale of Aviation Technologies, and the $18 million

after-tax gain ($0.02 per diluted share) recognized upon

redemption of our $300 million cash-settled senior convertible

notes. Net income in 2003 was adversely impacted by the $37

million after-tax investment impairment charge ($0.03 per

diluted share) described previously. Net income in 2003 was

also favorably impacted by reductions in income tax expense of

$116 million ($0.10 per diluted share) due to the resolution of

various tax issues with the IRS, a favorable court ruling on the

tax treatment of jet engine maintenance costs, and a lower

effective state tax rate.

2003 compared to 2002

Net income for 2003 was $2.898 billion, a decrease of $284 mil-

lion from the $3.182 billion achieved in 2002, resulting in a

decrease in diluted earnings per share to $2.55 in 2003 from

$2.81 in 2002. Net income in 2003 was affected by the items

noted above. Net income in 2002 was favorably impacted by a

$776 million after-tax ($0.68 per diluted share) benefit resulting

from the reversal of a portion of the previously established tax

assessment liability, and by $121 million after-tax ($0.11 per

diluted share) from the credit to expense as a result of the

change in our vacation policy for non-union employees. Net

income in 2002 was adversely impacted by $65 million after-tax

($0.06 per diluted share) due to the restructuring charge and

related expenses and by $72 million after-tax ($0.06 per diluted

share) due to the FAS 142 cumulative expense adjustment.

Liquidity and Capital Resources

Net Cash From Operating Activities

Net cash provided by operating activities was $5.331, $4.576,

and $5.688 billion in 2004, 2003 and 2002, respectively. The

increase in 2004 operating cash flows compared with 2003 was

primarily due to higher net income, decreased pension and retire-

ment plan fundings, and cash received upon the resolution of

various tax matters. In 2004, we funded $450 million to our pen-

sion plans as compared to $1.136 billion in 2003. As discussed in

Note 5 to the consolidated financial statements, projected pen-

sion contributions to plan trusts in 2005 are approximately $723

million. In 2004, we received $610 million from our previously

disclosed settlement with the Internal Revenue Service (IRS) pri-

marily on tax matters related to excess value package insurance