UPS 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 UPS Annual Report 2004

Notes to consolidated financial statements

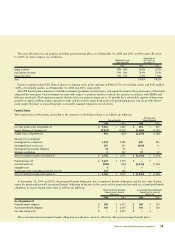

The amortized cost and estimated fair value of marketable

securities and short-term investments at December 31, 2004, by

contractual maturity, are shown below (in millions). Actual

maturities may differ from contractual maturities because the

issuers of the securities may have the right to prepay obligations

without prepayment penalties. Estimated

Cost Fair Value

Due in one year or less $ 37 $ 37

Due after one year through three years 459 458

Due after three years through five years 75 75

Due after five years 2,286 2,287

2,857 2,857

Equity securities 1,609 1,601

$ 4,466 $ 4,458

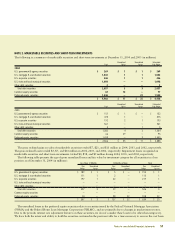

NOTE 3. FINANCE RECEIVABLES

The following is a summary of finance receivables at December

31, 2004 and 2003 (in millions):

2004 2003

Commercial term loans $360 $438

Investment in finance leases 188 270

Asset-based lending 285 290

Receivable factoring 191 468

Gross finance receivables 1,024 1,466

Less: Allowance for credit losses (25) (52)

Balance at December 31 $999 $ 1,414

Outstanding receivable balances at December 31, 2004 and

2003 are net of unearned income of $35 and $48 million,

respectively. When we “factor” (i.e., purchase) a customer

invoice from a client, we record the customer receivable as an

asset and also establish a liability for the funds due to the client,

which is recorded in accounts payable on the consolidated bal-

ance sheet. The following is a reconciliation of receivable

factoring balances at December 31, 2004 and 2003 (in millions):

2004 2003

Customer receivable balances $ 191 $ 468

Less: Amounts due to client (112) (195)

Net funds employed $79 $ 273

Non-earning finance receivables were $38 and $67 million at

December 31, 2004 and 2003, respectively. The following is a

rollforward of the allowance for credit losses on finance receiv-

ables (in millions):

2004 2003

Balance at January 1 $52 $38

Provisions charged to operations 14 39

Charge-offs, net of recoveries (41) (25)

Balance at December 31 $25 $52

The carrying value of finance receivables at December 31,

2004, by contractual maturity, is shown below (in millions).

Actual maturities may differ from contractual maturities because

some borrowers have the right to prepay these receivables with-

out prepayment penalties. Carrying

Value

Due in one year or less $ 530

Due after one year through three years 81

Due after three years through five years 99

Due after five years 314

$ 1,024

Based on interest rates for financial instruments with similar

terms and maturities, the estimated fair value of finance receiv-

ables is approximately $991 million and $1.384 billion as of

December 31, 2004 and 2003, respectively. At December 31,

2004, we had unfunded loan commitments totaling $344 mil-

lion, consisting of standby letters of credit of $53 million and

other unfunded lending commitments of $291 million.

NOTE 4. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment as of December 31 consists of the

following (in millions):

2004 2003

Vehicles $ 3,784 $ 3,486

Aircraft (including aircraft under

capitalized leases) 11,590 10,897

Land 760 721

Buildings 2,164 2,083

Leasehold improvements 2,347 2,219

Plant equipment 4,641 4,410

Technology equipment 1,596 1,495

Equipment under operating lease 57 53

Construction-in-progress 539 450

27,478 25,814

Less: Accumulated depreciation

and amortization (13,505) (12,516)

$13,973 $13,298