Thrifty Car Rental 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

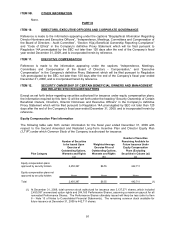

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

The Company maintains a set of disclosure controls and procedures designed to ensure that

information required to be disclosed by the Company in reports that it files or submits under the

Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the

time periods specified in Securities and Exchange Commission (“SEC”) rules and forms. The

disclosure controls and procedures are also designed with the objective of ensuring such

information is accumulated and communicated to the Company’s management, including the

Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), as appropriate, to allow

timely decisions regarding required disclosures. In designing and evaluating the disclosure

controls and procedures, management recognized that disclosure controls and procedures, no

matter how well conceived and operated, can provide only reasonable, not absolute, assurance

that the objectives of the disclosure controls and procedures are met. Additionally, in designing

the disclosure controls and procedures, the Company’s management was required to apply its

judgment in evaluating the cost-benefit relationship of possible disclosure controls and

procedures.

As required by SEC Rule 13a-15(b), the Company carried out an evaluation, under the

supervision and with the participation of the Company’s management, including the CEO and

CFO, of the effectiveness of the design and operation of the Company’s disclosure controls and

procedures as of the end of the period covered by this report. Based on that evaluation, the CEO

and CFO have concluded that the Company’s disclosure controls and procedures are effective at

the reasonable assurance level as of the end of the period covered by this report.

Internal Control Over Financial Reporting

Management’s Annual Report on Internal Control Over Financial Reporting

The management of the Company is responsible for establishing and maintaining adequate

internal control over financial reporting. The internal control system was designed to provide

reasonable assurance to the Company’s management and board of directors regarding the

preparation and fair presentation of published financial statements.

All internal control systems, no matter how well designed, have inherent limitations. Therefore,

even those systems determined to be effective can provide only reasonable assurance with

respect to financial statement preparation and presentation.

The Company’s management assessed the effectiveness of the Company’s internal control over

financial reporting as of December 31, 2009. In making this assessment, the Company used the

criteria for effective internal control over financial reporting set forth in Internal Control –

Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway

Commission (COSO). Based on management’s assessment, management asserts that as of

December 31, 2009, the Company’s internal control over financial reporting is effective based on

those criteria.

87