Thrifty Car Rental 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

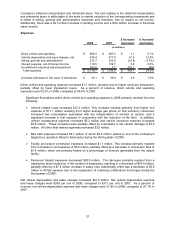

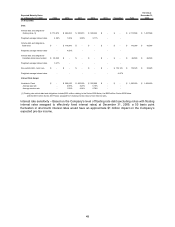

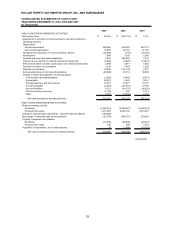

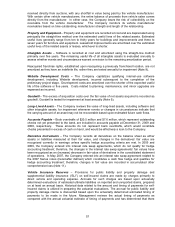

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

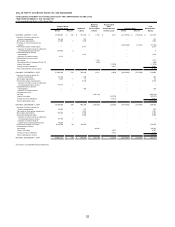

The table below provides information about the Company’s market sensitive financial instruments and

constitutes a “forward-looking statement.” The Company’s primary market risk exposure is volatility of

interest rates, primarily in the United States. The Company manages interest rates through use of a

combination of fixed and floating rate debt and interest rate swap agreements (see Item 8 - Note 11 of

Notes to Consolidated Financial Statements). All items described are non-trading and are stated in U.S.

dollars. Because a portion of the Company’s debt is denominated in Canadian dollars, its carrying value

is impacted by exchange rate fluctuations. However, this foreign currency risk is mitigated by the

underlying collateral which is the Canadian fleet. Other foreign exchange risk is immaterial to the

consolidated results and financial condition of the Company. The fair value and average receive rate of

the interest rate swaps is calculated using projected market interest rates over the term of the related

debt instruments as provided by the counterparties.

Fair Value

Expected Maturity Dates December 31,

as of December 31, 2009 2010 2011 2012 2013 2014 Thereafter Total 2009

(in thousands)

Debt:

Vehicle debt and obligations-

floating rates (1) 390,000$ 500,000$ 500,000$ -$ -$ -$ 1,390,000$ 1,307,100$

Weighted average interest rates 1.05% 2.57% 3.66% - - -

Vehicle debt and obligations-

fixed rates 110,000$ -$ -$ -$ -$ -$ 110,000$ 110,408$

Weighted average interest rates 4.59% - - - - -

Vehicle debt and obligations-

Canadian dollar denominated 69,690$ -$ -$ -$ -$ -$ 69,690$ 69,690$

Weighted average interest rates 1.21% - - - - -

Non-vehicle debt - term loan 10,000$ 10,000$ 10,000$ 128,125$ -$ -$ 158,125$ 143,894$

Weighted average interest rates 3.18% 4.65% 5.82% 6.57% - -

Interest Rate Swaps:

Variable to Fixed 390,000$ 500,000$ 500,000$ -$ -$ -$ 1,390,000$ 1,465,371$

Average pay rate 4.89% 5.27% 5.16% - - -

Average receive rate 0.68% 2.15% 3.32% - - -

(1) Floating rate vehicle debt and obligations include $290 million relating to the Series 2005 Notes, the $600 million Series 2006 Notes

and the $500 million Series 2007 Notes swapped from floating interest rates to fixed interest rates.

47