Thrifty Car Rental 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Secured Credit Facilities

At December 31, 2009, the Company’s Senior Secured Credit Facilities were comprised of a $231.3

million Revolving Credit Facility and a $158.1 million Term Loan, both of which expire on June 15, 2013.

The Senior Secured Credit Facilities contain certain financial and other covenants, including a covenant

to maintain a minimum adjusted tangible net worth of $150 million and a minimum of $100 million of

unrestricted cash and cash equivalents, including $60 million that is required to be held in separate

accounts with the Collateral Agent to secure payment of amounts outstanding under the Term Loan and

letters of credit issued under the Revolving Credit Facility. The Senior Secured Credit Facilities contain

certain other restrictive covenants, including annual limitations on non-vehicle capital expenditures, and a

prohibition against cash dividends and share repurchases. Additionally, the Company executed liens in

favor of the banks encumbering seven additional properties not previously encumbered as well as certain

vehicles not pledged as collateral under another vehicle financing facility. The Senior Secured Credit

Facilities are collateralized by a first priority lien on substantially all material non-vehicle assets and

certain vehicle assets not pledged as collateral under a vehicle financing facility. Additionally, in

connection with the amendment, the Company expensed approximately $1.0 million of unamortized

deferred financing costs as a result of the extinguishment of debt in the first quarter of 2009. As of

December 31, 2009, the Company is in compliance with all covenants.

The Revolving Credit Facility expires on June 15, 2013, and is restricted to use for letters of credit as no

revolving credit borrowings are permitted under the amended facility. The Revolving Credit Facility

contains sub-limits of $40 million and $100 million that restrict the amount of capacity available for letters

of credit to be used as vehicle enhancement in both its Canadian and U.S. operations, respectively. The

Company had letters of credit outstanding under the Revolving Credit Facility of approximately $141.6

million and remaining available capacity of $89.7 million at December 31, 2009.

The amended Term Loan requires the Company to make minimum quarterly principal payments of $2.5

million beginning in March 2010, with a final payment of $128 million in June 2013.

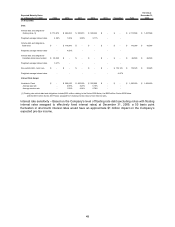

Debt Servicing Requirements

The Company will continue to have substantial debt and debt service requirements under its financing

arrangements. As of December 31, 2009, the Company’s total consolidated debt and other obligations

were approximately $1.7 billion, of which $1.6 billion was secured debt for the purchase of vehicles. The

majority of the Company’s vehicle debt is issued by special purpose finance entities as described herein,

all of which are fully consolidated into the Company’s financial statements. The Company has scheduled

annual principal payments for vehicle debt of approximately $570 million in 2010 and approximately $500

million per year for 2011 and 2012.

The Company intends to use cash generated from operations to fund non-vehicle capital expenditures,

subject to restrictions under its debt instruments, and proceeds from the sale of vehicles for debt service

and vehicle purchases. The Company has historically repaid its debt and funded its capital investments

(aside from growth in its rental fleet) with cash provided from operations and from the sale of vehicles.

The Company has funded growth in its vehicle fleet by incurring additional secured vehicle debt and with

cash generated from operations.

The Company has significant requirements for bonds and letters of credit to support its insurance

programs, airport concession and other obligations. At December 31, 2009, various insurance

companies had $40.8 million in surety bonds and various banks had $71.3 million in letters of credit to

secure these obligations. At December 31, 2009, these surety bonds and letters of credit had not been

drawn upon.

Interest Rate Risk

The Company’s results of operations depend significantly on prevailing levels of interest rates because of

the large amount of debt it incurs to purchase vehicles. In addition, the Company is exposed to increases

in interest rates because a portion of its debt bears interest at floating rates. The Company estimates that,

in 2010, approximately 25% of its average debt will bear interest at floating rates. The amount of the

Company’s financing costs affects the amount the Company must charge its customers to be profitable.

See Item 8 - Note 10 of Notes to Consolidated Financial Statements.

43