Thrifty Car Rental 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The total intrinsic value of options exercised during 2009, 2008 and 2007 was $0.6 million, $28,000,

and $1.4 million, respectively. Total cash received for non-qualified option rights exercised during

2009, 2008 and 2007 totaled $2.3 million, $30,000 and $1.1 million, respectively. The Company

deems a tax benefit to be realized when the benefit provides incremental benefit by reducing current

taxes payable that it otherwise would have had to pay absent the share-based compensation

deduction (the “with-and-without” approach). Under this approach, share-based compensation

deductions are, effectively, always considered last to be realized. Due to full utilization of the net

operating losses in 2009, the Company realized $1.3 million in tax benefits from the options

exercised. The Company did not realize any tax benefits from option exercises during 2008 or 2007.

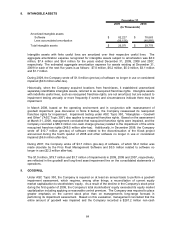

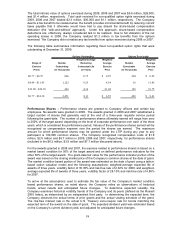

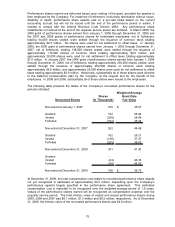

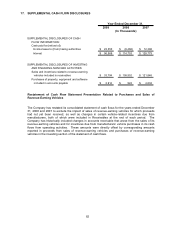

The following table summarizes information regarding fixed non-qualified option rights that were

outstanding at December 31, 2009:

Weighted-Average Weighted- Weighted-

Range of Number Remaining Average Number Average

Exercise Outstanding Contractual Life Exercise Exercisable Exercise

Prices (In Thousands) (In Years) Price (In Thousands) Price

$0.77 - $0.97 846 8.75 0.95$ 284 0.95$

$4.44 - $11.45 1,122 9.25 4.54 16 11.45

$13.98 - $24.38 483 4.34 21.02 183 19.75

$0.77 - $24.38 2,451 8.11 6.55$ 483 8.41$

Options Outstanding Options Exercisable

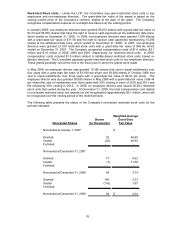

Performance Shares – Performance shares are granted to Company officers and certain key

employees. No awards were granted in 2009. The awards granted in 2008 and 2007 established a

target number of shares that generally vest at the end of a three-year requisite service period

following the grant-date. The number of performance shares ultimately earned will range from zero

to 200% of the target award, depending on the level of corporate performance over each of the three

years, which is considered the performance period. Values of the performance shares earned will be

recognized as compensation expense over the period the shares are earned. The maximum

amount for which performance shares may be granted under the LTIP during any year to any

participant is 160,000 common shares. The Company recognized compensation costs of $1.9

million, $2.8 million and $6.7 million in 2009, 2008 and 2007, respectively, for performance shares

(included in the $6.2 million, $3.9 million and $7.7 million discussed above).

For the awards granted in 2008 and 2007, the expense related to performance shares is based on a

market based condition for 50% of the target award and on defined performance indicators for the

other 50% of the target award. The grant-date fair value for the performance indicator portion of the

award was based on the closing market price of the Company’s common shares at the date of grant.

The market condition based portion of the award was estimated on the date of grant using a lattice-

based option valuation model and the following assumptions: weighted-average expected life of

awards of three years, volatility factor of 35.30% and risk-free rate of 2.32% for 2008, and weighted-

average expected life of awards of three years, volatility factor of 28.10% and risk-free rate of 4.88%

for 2007.

To arrive at the assumptions used to estimate the fair value of the Company’s market condition

based performance shares, as noted above, the Company relies on observations of historical

trends, actual results and anticipated future changes. To determine expected volatility, the

Company examines historical volatility trends of the Company and its peers (defined as the Russell

2000 Index), as determined by an independent third party. In determining the expected term, the

Company observes the actual terms of prior grants and the actual vesting schedule of the grant.

The risk-free interest rate is the actual U.S. Treasury zero-coupon rate for bonds matching the

expected term of the award on the date of grant. The expected dividend yield was estimated based

on the Company’s current dividend yield, and adjusted for anticipated future changes.

74