Thrifty Car Rental 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

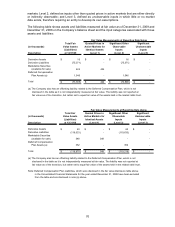

charge (pre-tax) related to the impairment of goodwill ($223.5 million after-tax) during the first

quarter of 2008, which represents the total accumulated impairment loss. The Company had no

goodwill on its balance sheet at December 31, 2009 or 2008.

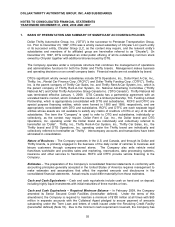

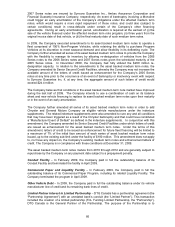

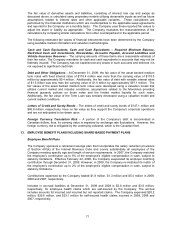

10. DEBT AND OTHER OBLIGATIONS

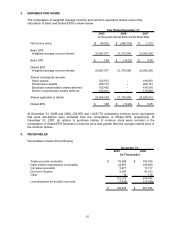

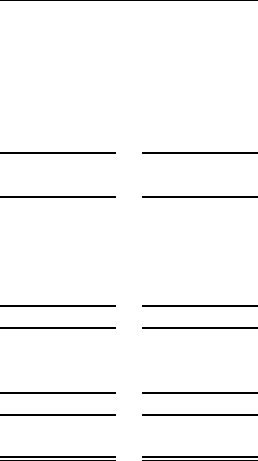

Debt and other obligations consist of the following:

2009 2008

Vehicle debt and other obligations

Asset backed medium term notes

2007 Series notes (matures July 2012) 500,000$ 500,000$

2006 Series notes (matures May 2011) 600,000 600,000

2005 Series notes (matures June 2010) 400,000 400,000

1,500,000 1,500,000

Discounts on asset backed medium term notes (5) (14)

Asset backed medium term notes, net of discount 1,499,995 1,499,986

Conduit Facility - 215,000

Commercial paper (including draws on Liquidity Facility) - 274,901

Other vehicle debt - 233,698

Limited partner interest in limited partnership (Canadian fleet financing) 69,690 86,535

Total vehicle debt and other obligations 1,569,685 2,310,120

Non-vehicle debt

Term Loan 158,125 178,125

Total non-vehicle debt 158,125 178,125

Total debt and other obligations 1,727,810$ 2,488,245$

December 31,

(In Thousands)

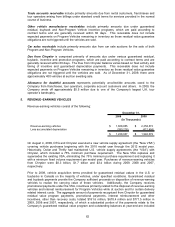

Asset Backed Medium Term Notes are comprised of rental car asset backed medium term notes

issued by RCFC in May 2007 (the “2007 Series notes”), March 2006 (the “2006 Series notes”) and

April 2005 (the “2005 Series notes”).

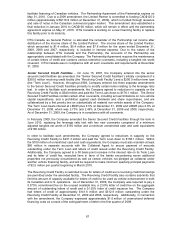

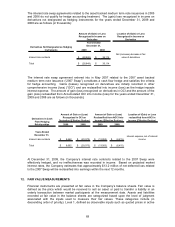

The 2007 Series notes are floating rate notes that were converted to a fixed rate of 5.16% by

entering into interest rate swap agreements (Note 11) in conjunction with the issuance of the notes.

The 2006 Series notes are floating rate notes that were converted to a fixed rate of 5.27% by

entering into interest rate swap agreements (Note 11) in conjunction with the issuance of the notes.

The 2005 Series notes are comprised of $110.0 million 4.59% fixed rate notes and $290.0 million of

floating rate notes. In conjunction with the issuance of the 2005 Series notes, the Company also

entered into interest rate swap agreements (Note 11) to convert $190.0 million of the floating rate

debt to fixed rate debt at a 4.58% interest rate. Additionally, in December 2006, the Company

entered into an interest rate swap agreement to convert the remaining $100.0 million of the floating

rate debt to fixed rate debt at a 5.09% interest rate.

The assets of RCFC, including revenue-earning vehicles related to the asset backed medium term

notes, restricted cash and investments, and certain receivables related to revenue-earning vehicles

are available to satisfy the claims of its creditors. Dollar and Thrifty lease vehicles from RCFC under

the terms of a master lease and servicing agreement. The asset backed medium term note

indentures also provide for additional credit enhancement through over collateralization of the

vehicle fleet, cash or letters of credit and maintenance of a liquidity reserve. RCFC is in compliance

with the terms of the indentures.

Each of the asset backed medium term note programs have financial guarantee insurance

underwritten by a monoline or bond insurer (“Monoline”) and each contains a minimum net worth

condition and an interest coverage condition. The 2005 Series notes, the 2006 Series notes and the

65