Thrifty Car Rental 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

respectively, for state net operating losses. At December 31, 2009, DTG Canada has net operating

loss carryforwards of approximately $61.3 million available to offset future taxable income in

Canada, which expire beginning in 2010 through 2029. Valuation allowances have been established

for the total estimated future tax effect of the Canadian net operating losses and other deferred tax

assets.

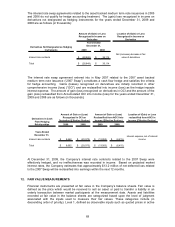

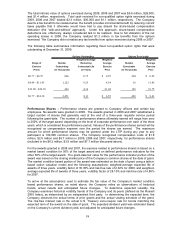

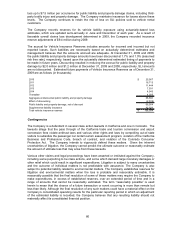

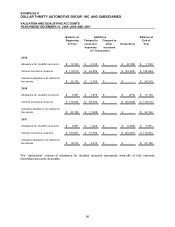

The Company’s effective tax rate differs from the maximum U.S. statutory income tax rate. The

following summary reconciles taxes at the maximum U.S. statutory rate with recorded taxes:

Amount Percent Amount Percent Amount Percent

(Amounts in Thousands)

Tax expense computed at the

maximum U.S. statutory rate

28,353$ 35.0% (159,880)$ 35.0% 4,483$ 35.0%

Difference resulting from:

State and local taxes, net of

federal income tax benefit

7,007 8.6% (12,117) 2.7% 3,130 24.4%

Foreign losses

1,111 1.4% 7,701 (1.7%) 3,617 28.2%

Foreign taxes

633 0.8% 588 (0.1%) 275 2.2%

Nondeductible impairment

- 0.0% 50,045 (11.0%) - 0.0%

Other

(1,118) (1.4%) 3,580 (0.8%) 88 0.7%

Total

35,986$ 44.4% (110,083)$ 24.1% 11,593$ 90.5%

Year Ended December 31,

2009 2008 2007

The Company had no material liability for unrecognized tax benefits and no material adjustments to

the Company’s opening financial position were required under ASC Topic 740, upon adoption or at

December 31, 2009. There are no material tax positions for which it is reasonably possible that

unrecognized tax benefits will significantly change in the twelve months subsequent to December

31, 2009.

The Company files income tax returns in the U.S. federal and various state, local and foreign

jurisdictions. In the Company’s significant tax jurisdictions, the tax years 2006 and later are subject

to examination by federal taxing authorities and the tax years 2005 and later are subject to

examination by state and foreign taxing authorities.

The Company accrues interest and penalties on underpayment of income taxes related to

unrecognized tax benefits as a component of income tax expense in the consolidated statement of

operations. No amounts were recognized for interest and penalties under ASC Topic 740 during the

years ended December 31, 2009, 2008 and 2007.

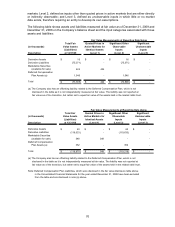

Restatement Relating to 2008 Income Tax Benefit and Deferred Tax Liability

In late 2009, the Company’s management determined that the income tax benefit for 2008 was

overstated by $6.3 million resulting from an error in calculating the tax benefit of the write-off of

reacquired franchise rights. During the first quarter of 2008, the Company wrote off approximately

$69 million of reacquired franchise rights, all of which resulted from asset acquisitions except for $17

million from a stock acquisition. Reacquired franchise rights acquired in a stock acquisition are

considered a permanent difference that does not create a tax benefit. Income tax benefit of

approximately $110.1 million was decreased from the originally reported amount of $116.4 million

and net loss of approximately $346.7 million was increased from the originally reporting amount of

approximately $340.4 million. Basic and diluted loss per share of $16.22, increased from the

originally reported amount of $15.93 per share. The deferred tax liability of approximately $139.9

million increased from approximately $133.6 million as originally reported and accumulated deficit of

approximately $338.2 million increased from approximately $331.9 million as originally reported.

This error is a book basis difference only and therefore had no cash impact in 2008 and will not

impact cash taxes in future periods.

78