Thrifty Car Rental 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

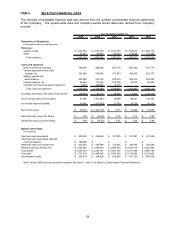

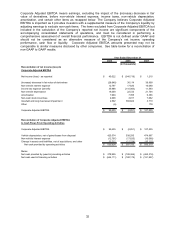

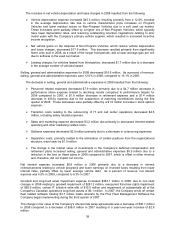

Corporate Adjusted EBITDA means earnings, excluding the impact of the (increase) decrease in fair

value of derivatives, before non-vehicle interest expense, income taxes, non-vehicle depreciation,

amortization, and certain other items as recapped below. The Company believes Corporate Adjusted

EBITDA is important as it provides investors with a supplemental measure of the Company's liquidity by

adjusting earnings to exclude non-cash items. The items excluded from Corporate Adjusted EBITDA but

included in the calculation of the Company’s reported net income are significant components of the

accompanying consolidated statements of operations, and must be considered in performing a

comprehensive assessment of overall financial performance. EBITDA is not defined under GAAP and

should not be considered as an alternative measure of the Company's net income, operating

performance, cash flow or liquidity. Corporate Adjusted EBITDA amounts presented may not be

comparable to similar measures disclosed by other companies. See table below for a reconciliation of

non-GAAP to GAAP results.

2009 2008 2007

(in thousands)

Reconciliation of net income (loss) to

Corporate Adjusted EBITDA

Net income (loss) - as reported 45,022$ (346,718)$ 1,215$

(Increase) decrease in fair value of derivatives (28,848) 36,114 38,990

Non-vehicle interest expense 12,797 17,620 16,068

Income tax expense (benefit) 35,986 (110,083) 11,593

Non-vehicle depreciation 19,200 22,722 21,704

Amortization 7,994 7,355 6,386

Non-cash stock incentives 4,698 3,917 7,682

Goodwill and long-lived asset impairment 2,592 366,822 3,719

Other (6) - 178

Corporate Adjusted EBITDA 99,435$ (2,251)$ 107,535$

Reconciliation of Corporate Adjusted EBITDA

to Cash Flows From Operating Activities

Corporate Adjusted EBITDA 99,435$ (2,251)$ 107,535$

Vehicle depreciation, net of gains/losses from disposal 425,574 538,250 474,967

Non-vehicle interest expense (12,797) (17,620) (16,068)

Change in assets and liabilities, net of acquisitions, and other 23,712 (11,224) (10,115)

Net cash provided by operating activities 535,924$ 507,155$ 556,319$

Memo:

Net cash provided by (used in) investing activites 278,955$ (198,366)$ (465,318)$

Net cash used in financing activities (644,111)$ (180,178)$ (181,957)$

Year Ended December 31,

32