Thrifty Car Rental 2009 Annual Report Download - page 40

Download and view the complete annual report

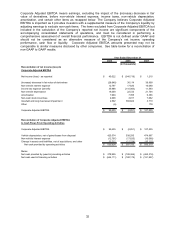

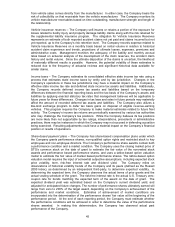

Please find page 40 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The income tax benefit for 2008 was $110.1 million. The effective income tax rate was 24.1% for 2008

compared to 90.5% for 2007. The decrease in the effective tax rate was primarily due to the taxable

benefit related to the pre-tax loss in 2008 compared to the pre-tax income in 2007 and the non-cash

write-off of goodwill and reacquired franchise rights (of which only a portion of these write-offs receive a

deferred tax benefit) and other long-lived assets. The Company reports taxable income for the U.S. and

Canada in separate tax jurisdictions and establishes provisions separately for each jurisdiction. On a

separate, domestic basis, the U.S. effective tax rate approximates the statutory tax rate including the

effect of state income taxes and the impact of establishing valuation allowances for net operating losses

that could expire. However, no income tax benefit was recorded for Canadian losses in 2008, due to an

overall pre-tax loss, thus reducing the consolidated effective tax rate and increasing the consolidated

effective tax rate in 2007.

Liquidity and Capital Resources

The Company’s primary uses of liquidity are for the purchase of vehicles for its rental fleets, including

required collateral enhancement under its fleet financing structures, non-vehicle capital expenditures and

for working capital. The Company uses both cash and letters of credit to support asset backed vehicle

financing programs. The Company also uses letters of credit or insurance bonds to secure certain

commitments related to airport concession agreements, insurance programs, and for other purposes.

The Company’s primary sources of liquidity are cash generated from operations, secured vehicle

financing, the Senior Secured Credit Facilities and insurance bonds. Also, in October 2009, the Company

completed an equity offering of its common stock which generated $120.6 million of proceeds, net of fees

paid to underwriters and other expenses.

The Company believes that its cash generated from operations, cash balances and secured vehicle

financing programs are adequate to meet its liquidity requirements during 2010. The Company has asset

backed medium term note maturities totaling $400 million that amortize ratably from January 2010,

through June 2010 and an additional $100 million in maturities in December 2010. The Company has

adequate cash on hand to fund these maturities without the need for additional financing, although it

intends to pursue additional financing capacity on an opportunistic basis. Despite improving conditions in

the asset backed medium term note market, the Company expects that new financing will require a

substantially higher collateral enhancement rate than its current medium term notes, but will have similar

interest rates. Although the financial markets were constrained during the first half of 2009, the fleet

financing markets improved during the second half of 2009 and into 2010, and the Company believes it

will be able to access funding to add capacity for future growth. In addition, based on its current cash

position which was enhanced by the equity offering in the fourth quarter of 2009, the Company has the

ability to meet such higher collateral requirements, and believes it would be able to refinance or replace

its asset backed medium term notes with other debt upon their maturity or in the event of an early

amortization.

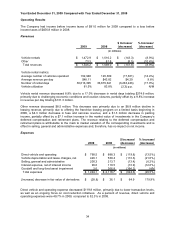

Operating Activities

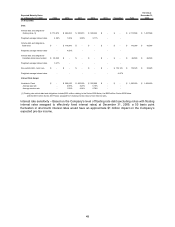

Cash generated by operating activities of $535.9 million, $507.2 million and $556.3 million for 2009, 2008,

and 2007, respectively, are primarily the result of net income, adjusted for depreciation, goodwill

impairments net of deferred tax benefits in 2008 and the change in fair value of derivatives. The liquidity

necessary for purchasing vehicles is primarily obtained from secured vehicle financing, most of which is

proceeds from sale of asset backed medium term notes, sales proceeds from disposal of used vehicles

and cash generated by operating activities. The asset backed medium term notes require varying levels

of credit enhancement or overcollateralization, which are provided by a combination of cash, vehicles,

and letters of credit. These letters of credit are provided under the Revolving Credit Facility.

Investing Activities

Cash provided by investing activities was $279.0 million for 2009. The principal source of cash in

investing activities was the sale of revenue-earning vehicles, which totaled $1.5 billion in proceeds. This

source of cash was partially offset by the purchase of revenue-earning vehicles, which totaled $1.1 billion

and the $100 million of cash and cash equivalents required to be maintained at all times under the

Company’s amendment of the Senior Secured Credit Facilities separately identified on the face of the

balance sheet as cash and cash equivalents – required minimum balance (see Item 8 - Note 1 of Notes to

Consolidated Financial Statements). The Company’s need for cash to finance vehicles typically peaks in

the second and third quarters of the year when fleet levels build to meet seasonal rental demand. Fleet

39