Thrifty Car Rental 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

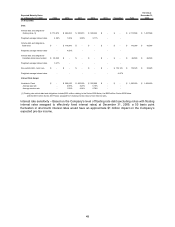

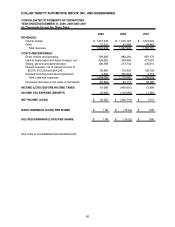

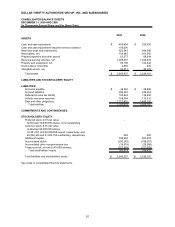

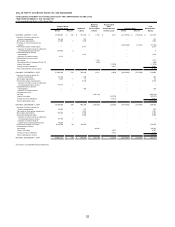

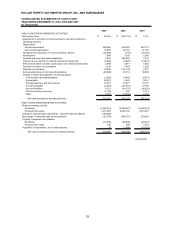

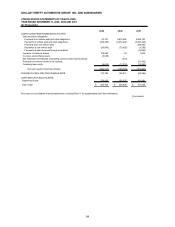

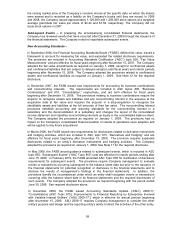

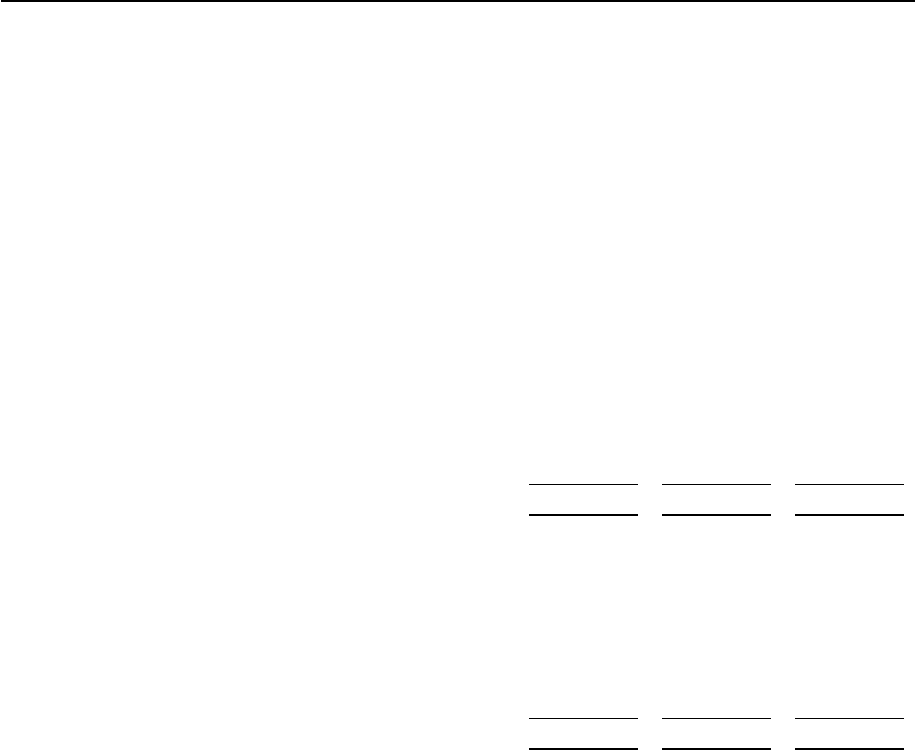

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Y

EAR ENDED DECEMBER 31, 2009, 2008 AND 2007

(In Thousands)

2009 2008 2007

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income (loss) 45,022$ (346,718)$ 1,215$

Adjustments to reconcile net income (loss) to net cash provided by

operating activities:

Depreciation:

Vehicle depreciation 460,660 539,024 493,712

Non-vehicle depreciation 19,200 22,722 21,704

Net gains from disposition of revenue-earning vehicles (35,086) (774) (18,745)

Amortization 7,994 7,355 6,386

Goodwill and long-lived asset impairment 2,592 366,822 3,719

Interest income earned on restricted cash and investments (3,202) (8,922) (13,975)

Performance share incentive, stock option and restricted stock plans 4,698 3,917 7,682

Provision for losses on receivables 3,129 7,878 1,022

Deferred income taxes 16,854 (112,107) 7,977

(Increase)/decrease in fair value of derivatives (28,848) 36,114 38,990

Change in assets and liabilities, net of acquisitions:

Income taxes receivable/payable (3,220) 10,489 (8,577)

Receivables 28,574 4,942 9,531

Prepaid expenses and other assets 12,275 33,973 16,167

Accounts payable (2,522) (27,931) 13,194

Accrued liabilities 6,761 (24,175) (34,226)

Vehicle insurance reserves (1,726) 276 6,113

Other 2,769 (5,730) 4,430

Net cash provided by operating activities 535,924 507,155 556,319

CASH FLOWS FROM INVESTING ACTIVITIES:

Revenue-earning vehicles:

Purchases (1,060,251) (2,249,227) (4,040,219)

Proceeds from sales 1,477,368 2,536,146 3,373,801

Change in cash and cash equivalents - required minimum balance (100,000) - -

Net change in restricted cash and investments (22,750) (454,721) 270,824

Property, equipment and software:

Purchases (15,508) (28,895) (40,647)

Proceeds from sales 104 399 1,215

Acquisition of businesses, net of cash acquired (8) (2,068) (30,292)

Net cash provided by (used in) investing activities 278,955 (198,366) (465,318)

(Continued)

53