Thrifty Car Rental 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

asset backed medium term notes in May 2007, the proceeds of the $250 million Term Loan in June 2007,

and an increase of $42.1 million in other existing bank vehicle lines of credit.

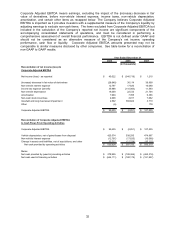

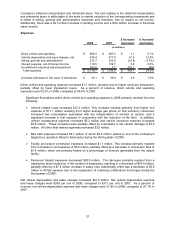

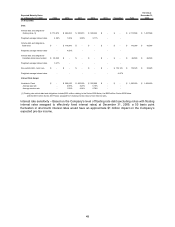

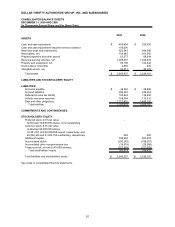

Contractual Obligations and Commitments

The Company has various contractual commitments primarily related to asset backed medium term notes

and short-term borrowings outstanding for vehicle purchases, a non-vehicle related term loan, airport

concession fee and operating lease commitments related to airport and other facilities, technology

contracts, and vehicle purchases. The Company expects to fund these commitments with cash

generated from operations, sales proceeds from disposal of used vehicles and future issuances of asset

backed notes as existing medium term notes mature. The following table provides details regarding the

Company’s contractual cash obligations and other commercial commitments subsequent to December

31, 2009:

Beyond

2010 2011-2012 2013-2014 2014 Total

Contractual cash obligations:

Asset backed medium term notes (1) 562,569$ 1,041,321$ -$ -$ 1,603,890$

Other short-term borrowings (1) 70,535 - - - 70,535

Subtotal - Vehicle debt and obligations 633,104 1,041,321 - - 1,674,425

Term Loan 14,871 34,422 132,134 - 181,427

Subtotal - Non-vehicle debt 14,871 34,422 132,134 - 181,427

Total debt and other obligations 647,975 1,075,743 132,134 - 1,855,852

Operating lease commitments 41,477 60,889 34,770 56,722 193,858

Airport concession fee commitments 76,363 122,720 80,437 104,216 383,736

Vehicle purchase commitments 1,409,129 - - - 1,409,129

Other commitments 24,463 24,033 - - 48,496

Total contractual cash obligations 2,199,407$ 1,283,385$ 247,341$ 160,938$ 3,891,071$

Other commercial commitments:

Letters of credit 147,142$ -$ -$ -$ 147,142$

Payments due or commitment expiration by period

(in thousands)

(1) Further discussion of asset backed medium term notes and short-term borrowings is below and in

Item 8 - Note 10 of Notes to Consolidated Financial Statements. Amounts include both principal

and interest payments. Amounts exclude related discounts, where applicable.

The Company also has self-insured liabilities related to third-party bodily injury and property damage

claims totaling $108.6 million that are not included in the contractual obligations and commitments table

above. See Item 8 - Note 15 of Notes to Consolidated Financial Statements.

Asset Backed Medium Term Notes

The asset backed medium term note program is comprised of $1.5 billion in asset backed medium term

notes with maturities ranging from 2010 to 2012. Borrowings under the asset backed medium term notes

are secured by eligible vehicle collateral and bear interest at fixed rates ranging from 4.58% to 5.27%

including certain floating rate notes swapped to fixed rates. The Company typically accesses the medium

term note market each year to replace maturing notes; however, the Company did not need to access this

market in 2008 or 2009. Proceeds from the asset backed medium term notes that are temporarily not

utilized for financing vehicles and certain related receivables are maintained in restricted cash and

investment accounts and are available for the purchase of vehicles. These amounts totaled

approximately $590.8 million at December 31, 2009.

41