Thrifty Car Rental 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

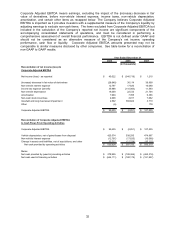

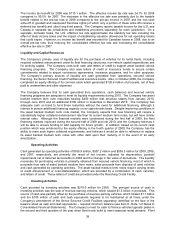

Use of Non-GAAP Measures For Measuring Results

Non-GAAP pretax income (loss), non-GAAP net income (loss) and non-GAAP EPS exclude the impact of

the (increase) decrease in fair value of derivatives and the impact of goodwill and long-lived asset

impairments, net of related tax impact (as applicable), from the reported GAAP measure. Due to volatility

resulting from the mark-to-market treatment of the derivatives and the nature of the non-cash

impairments, which are both non-operating items, the Company believes non-GAAP measures provide an

important assessment of year over year operating results. See table below for a reconciliation of non-

GAAP to GAAP results.

Reconciliation of reported GAAP pretax income (loss) per the

income statement to non-GAAP pretax income (loss):

2009 2008 2007

(in thousands)

Income (loss) before income taxes - as reported 81,008$ (456,801)$ 12,808$

(Increase) decrease in fair value of derivatives (28,848) 36,114 38,990

Goodwill and long-lived asset impairment 2,592 366,822 3,719

Pretax income (loss) - non-GAAP 54,752$ (53,865)$ 55,517$

Reconciliation of reported GAAP net income (loss) per the

income statement to non-GAAP net income (loss):

Net income (loss) - as reported 45,022$ (346,718)$ 1,215$

(Increase) decrease in fair value of derivatives, net of tax (a) (16,917) 21,271 22,813

Goodwill and long-lived asset impairment, net of tax (b) 1,497 284,537 2,236

Net income (loss) - non-GAAP 29,602$ (40,910)$ 26,264$

Reconciliation of reported GAAP diluted earnings (loss)

per share ("EPS") to non-GAAP diluted EPS:

EPS, diluted - as reported 1.88$ (16.22)$ 0.05$

EPS impact of (increase) decrease in fair value of derivatives, net of tax (0.71) 1.00 0.97

EPS impact of goodwill and long-lived asset impairment, net of tax 0.06 13.31 0.09

EPS, diluted - non-GAAP (c) 1.24$ (1.91)$ 1.11$

(a) The tax effect of the (increase) decrease in fair value of derivatives is calculated using the entity-specific, U.S. federal

and blended state tax rate applicable to the derivative instruments which amounts are ($11,931,000), $14,843,000

and $16,177,000 for the years ended December 31, 2009, 2008 and 2007, respectively.

(b) The tax effect of the goodwill and long-lived asset impairment is calculated using the tax-deductible portion of

the impairment and applying the entity-specific, U.S. federal and blended state tax rate which amounts are

$1,095,000, $82,285,000 and $1,483,000 for the years ended December 31, 2009, 2008 and 2007, respectively.

(c) Since each category of earnings per share is computed independently for each period, total per share amounts may

not equal the sum of the respective categories.

Year Ended December 31,

31