Thrifty Car Rental 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.that most significantly impact the other entity’s economic performance when determining whether a

variable interest entity should be consolidated. The Company adopted the provisions of ASU 2009-

17 as required on January 1, 2010 and does not believe it will have a significant impact on the

Company’s consolidated financial statements.

In June 2009, the FASB issued “The FASB Accounting Standards CodificationTM and the Hierarchy

of Generally Accepted Accounting Principles” which is effective for interim periods ending after

September 15, 2009 and is included in ASC topic 105, “Generally Accepted Accounting Principles.”

This establishes the FASB Accounting Standards CodificationTM as the only source of authoritative

accounting principles recognized by the FASB to be applied by nongovernmental entities in the

preparation of financial statements in conformity with GAAP, with the exception of Statements of

Financial Accounting Standards not yet included in the Codification. The Company adopted the

FASB ASC as required for the period ended September 30, 2009.

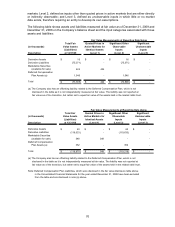

In January 2010, the FASB issued ASU 2010-06, “Fair Value Measurements and Disclosures (ASC

Topic 820): Improving Disclosures about Fair Value Measurements” which amends ASC Subtopic

820, “Fair Value Measurements and Disclosures” (“ASU 2010-06”) to add new requirements for

disclosures about transfers into and out of Levels 1 and 2 and separate disclosures about

purchases, sales, issuances, and settlements relating to Level 3 measurements. ASU 2010-06

also clarifies existing fair value disclosures about the level of disaggregation and about inputs and

valuation techniques used to measure fair value. The Company adopted the provisions of ASU

2010-06 as required on January 1, 2010 and will include the required disclosures in the first quarter

2010 Form 10-Q.

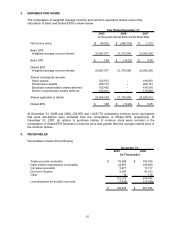

2. PUBLIC STOCK OFFERING

On October 28, 2009, the Company entered into a terms agreement with certain underwriters to

issue and sell 5,750,000 shares of the Company’s common stock, par value $0.01 per share, at a

price to the public of $19.25 per share. The Company also granted the underwriters an option to

purchase up to an additional 862,500 shares of common stock. The sale was made pursuant to the

Company’s registration statement on Form S-3 filed with the Securities and Exchange Commission.

The sale of the initial shares closed on November 3, 2009, and the sale of the additional shares

pursuant to the underwriters’ option to purchase additional shares closed on November 11, 2009.

The 6,612,500 shares issued resulted in $120.6 million of net proceeds to the Company after

deducting underwriting discounts, commissions and expenses of the offering of $6.6 million. The

Company intends to use the net proceeds from the offering for general corporate purposes.

60