Thrifty Car Rental 2009 Annual Report Download - page 43

Download and view the complete annual report

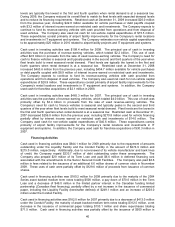

Please find page 43 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In February 2009, the Company amended all series of its asset backed medium term note program to be

able to operate a fleet comprised of 100% Non-Program Vehicles, while retaining the ability to purchase

Program Vehicles at its discretion to meet seasonal demand and allow flexibility in its defleeting cycle.

In June 2009, the Company amended all series of its asset backed medium term note program to provide

the Company with flexibility to manage its inventory by allowing re-designation of vehicles from the Series

2005-1 Notes to the Series 2006-1 Notes and Series 2007-1 Notes given the scheduled maturity of the

Series 2005-1 Notes. In November 2009, the Company had fully utilized the $200 million re-designation

capacity. In relation to the amendments to the medium term note programs, the Company amended its

Senior Secured Credit Facilities, whereby the Company may not increase the available amount of the

letters of credit issued as enhancement for the Company’s Series 2005-1 Notes at any time prior to the

occurrence of an event of bankruptcy or insolvency event with respect to a Monoline under the Series

2005-1 Notes if, at any time, the aggregate undrawn amount of such letters of credit and unpaid

reimbursement obligations in respect thereof were greater than $24.4 million or if the requested increase

would cause the Series 2005-1 letter of credit amount to exceed that amount.

In August 2009, the Company further amended all series of its asset backed medium term notes in order

to add Chrysler and General Motors as eligible vehicle manufacturers under the indenture supplements.

The related indenture supplements were also amended to cure any and all conditions that may have been

triggered as a result of the Chrysler bankruptcy and that could have constituted a “Manufacturer Event of

Default” as defined in the indenture supplements. In conjunction with this amendment, the Company

amended its Senior Secured Credit Facilities under which letters of credit are issued as enhancement for

the asset backed medium term notes. Under the terms of this amendment, letters of credit to be issued

as enhancement for future fleet financing will be limited to a maximum of 7% of the initial face amount of

each series of asset backed medium term notes issued, up to the existing sub-limit under the facility of

$100 million. This amendment does not apply to, nor have any impact on, the Company’s existing

medium term notes and enhancement letters of credit.

The asset backed medium term note programs each contain a minimum net worth condition and an

interest coverage condition in the Monoline agreements. The Company was in compliance with these

conditions at December 31, 2009.

Commercial Paper Program, Conduit and Liquidity Facility

In February 2009, the Company paid in full the outstanding balance of its Commercial Paper Program

(the “Commercial Paper Program”), including the related liquidity facility, and its Variable Funding Note

Purchase Facility (the “Conduit Facility”). The Company terminated these programs in April 2009.

Other Vehicle Debt and Obligations

The Company finances its Canadian vehicle fleet through a fleet securitization program. This program

provides DTG Canada vehicle financing up to CAD$200 million funded through a bank commercial paper

conduit; however, in 2009, the committed funding was reduced from CAD$200 million to CAD$125 million

in December 2009 (approximately US$118.9 million at December 31, 2009), with a final reduction in

January 2010 to CAD$100 million, which will remain in effect until the partnership agreement expires on

May 31, 2010. At December 31, 2009, DTG Canada had approximately CAD$73.3 million (US$69.7

million) funded under this program. The Company is working on a new CAD$150 million financing facility

to replace this facility prior to its maturity. The Canadian fleet securitization program contains a tangible

net worth covenant and DTG Canada was in compliance with this covenant at December 31, 2009.

In 2009, the Company paid in full the outstanding balance under its vehicle manufacturer line of credit

and its remaining bank lines of credit.

42